The Progressive Wage Credit Scheme, Singapore (PWCS) incentivizes businesses to raise the wages of their low-wage workers while boosting productivity. Understanding PWCS is vital for business owners, impacting compliance, growth, and corporate social responsibility. This article will explore PWCS, its eligibility, and how business owners can leverage it for financial and social benefits.

What is the Progressive Wage Credit Scheme (PWCS) in Singapore?

The Progressive Wage Credit Scheme is a vital support mechanism for Singaporean businesses. Launched in Budget 2022, it aims to help firms comply with the Progressive Wage and Local Qualifying Salary standards for compulsory wage increases for lower-paid employees. It also encourages them to enhance their lower-income employees’ earnings proactively.

The PWCS operates over five years, spanning from 2022 to 2026, aiming to ease the financial adjustment for employers. It consists of two tiers of support:

- The First Tier targets lower-income workers with gross monthly wages below $2,500.

- The Second Tier encompasses those with wages above $2,500 to $3,000.

For eligibility, employers must ensure that the average monthly wage increase per eligible worker reaches at least $100 annually. In addition, if the salary increase is maintained for two years, co-funding is granted for wage increments in each qualifying year.

Businesses need not initiate a formal application process for the PWCS. The government automatically disburses the support to eligible employers.

How Does the Progressive Wage Credit Scheme in Singapore Work?

The PWCS in Singapore is structured to support wage increases for eligible Singapore Citizens and Permanent Resident employees. Here’s how it works:

- Eligibility – The scheme is available to Singapore Citizens and Permanent Resident employees.

- Wage Ceiling – From 2022 through 2026, the government will fund salary increases up to a cap of $2,500 in gross monthly earnings.

- Minimum Increase – For each year, the average gross monthly wage increase must be at least $100.

- Extended Support – For wages above $2,500 and up to a $3,000 ceiling, there’s support from 2022 to 2024 due to economic uncertainty.

- Co-Funding Period – Each qualifying year’s eligible wage increases receive a two-year co-funding period. For instance, if a pay increase in 2022 is maintained, it will be supported in 2022 and 2023.

Who is Entitled to the Progressive Wage Credit Scheme?

To qualify for the PWCS in Singapore, your firm should give wage increases to resident employees, which include Singapore Citizens and Permanent Residents.

To break it down, here are the essential conditions:

- CPF Contributions – Your employees must have received contributions from one employer for at least three months before the qualifying year.

- Payroll Duration – These employees must have worked for your company for at least three months during the qualifying year. It implies that constant CPF payments had to be made during this time.

- Wage Increase – Your employees must have received an increase in average gross monthly pay of $100 or more during the qualifying year to be eligible.

Who is Exempted From the Progressive Wage Credit Scheme?

Benefits from the Progressive Wage Credit Scheme (PWCS) in Singapore are unavailable to local government entities such as Organs of State, Ministries, Departments, and Statutory Boards. The same holds for public and publicly funded educational institutions, PA services, and grassroots units.

Foreign entities not registered in Singapore are also ineligible for PWCS. It includes foreign high commissions, embassies, trade offices, and consulates operating within the country. Foreign military units, foreign government agencies, representative offices of foreign companies, foreign chambers, foreign non-profit organizations, foreign law practices, and foreign trade associations are all examples of excluded entities.

Wages paid directly to individuals such as partners in a partnership, sole proprietors, or individuals who simultaneously hold positions as shareholders and directors in a company are not eligible for PWCS benefits.

How Do You Calculate the Progressive Wage Credit Scheme Singapore Payouts?

To determine your payout, consider two co-funding tiers, depending on your employees’ gross monthly wages.

There are two co-funding tiers under PWCS: the first and the second. The co-funding level you are eligible for depends on the gross monthly wages of your employees. Here are the co-funding levels for each tier:

- First Tier – Applicable to employees with a gross monthly wage ceiling of ≤ $2,500.

- Second Tier – Applicable to employees with a gross monthly wage ceiling of > $2,500 and ≤ $3,000.

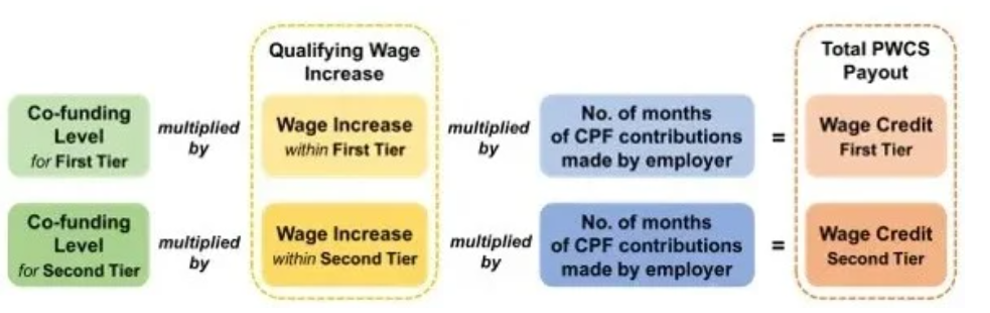

To calculate your PWCS payouts, use one of the following formulas, depending on your co-funding level:

- First Tier Co-Funding Level – Multiply your wage increase by the number of months of CPF contributions made by the employer. The result is your Wage Credit.

- Second Tier Co-Funding Level – Similarly, multiply your wage increase by the number of months of CPF contributions made by the employer to calculate your Wage Credit.

How Can Businesses Apply For the Progressive Wage Credit Scheme?

Business owners and employers don’t need to submit separate applications to apply for the Progressive Wage Credit Scheme in Singapore. The system operates on automatic registration for qualifying businesses, removing the need for manual initiation.

Once eligible, the Inland Revenue Authority of Singapore (IRAS) handles reimbursement through two approved payment options. The primary method involves direct credit into the company’s GIRO bank account. Alternatively, IRAS can pay for the company’s PayNow account if a GIRO account is unavailable. These are the exclusive channels for PWCS reimbursements. There would not be any PWCS payout made via cheques. Companies that are selected will receive a letter from IRAS, requesting the submission of supporting documents for review. The payouts scheduled for March 2023 will be temporarily held, and you might need to furnish a declaration or additional documents to verify your eligibility for the PWCS payout. The payout will only released once the review process has been successfully completed.

How We Can Help: Our Payroll Service

Leveraging our in-depth knowledge of the Progressive Wage Credit Scheme (PWCS) and local labor regulations, Premia TNC ensures your payroll aligns seamlessly with PWCS requirements to maximize your benefits. We handle CPF calculations, tax reporting, and regulatory tasks, freeing up your time and ensuring full compliance.

Our flexible, customized solutions are designed to fit your business, regardless of size. As we simplify your payroll processes, we enable you to concentrate on business growth and strategic objectives. Contact Premia TNC today for a FREE consultation to explore how our payroll services can enhance your operations.

Progressive Wage Credit Scheme Singapore – Frequently Asked Questions

1. Who is eligible to benefit from the PWCS?

Employers in various sectors, including cleaning, security, and landscape maintenance, are eligible if they meet the scheme’s criteria. Businesses must have tried to increase wages for their low-wage employees and support their skills upgrading.

2. How does the PWCS benefit employers?

Employers can co-fund salary hikes for their low-paid employees through the PWCS. This co-funding encourages companies to enhance employee pay while lowering the expense of wage increases.

3. Is the PWCS the same as the WCS?

No, the Progressive Wage Credit Scheme (PWCS) differs from WCS. The WCS was a temporary initiative aimed at aiding businesses in their transformation endeavors and encouraging workers to partake in productivity gains. The Wage Credit Scheme (WCS) has concluded in March 2022.