The company secretary is the company’s executive officer, in charge of its day-to-day operations and compliance with laws and regulations. Therefore, it is essential for the company secretary to be conversant with all laws that govern the company.

The Accounting and Corporate Regulatory Authority (ACRA) sets the Singapore company secretary requirements. This article will discuss everything you need to know about getting a certified company secretary in Singapore.

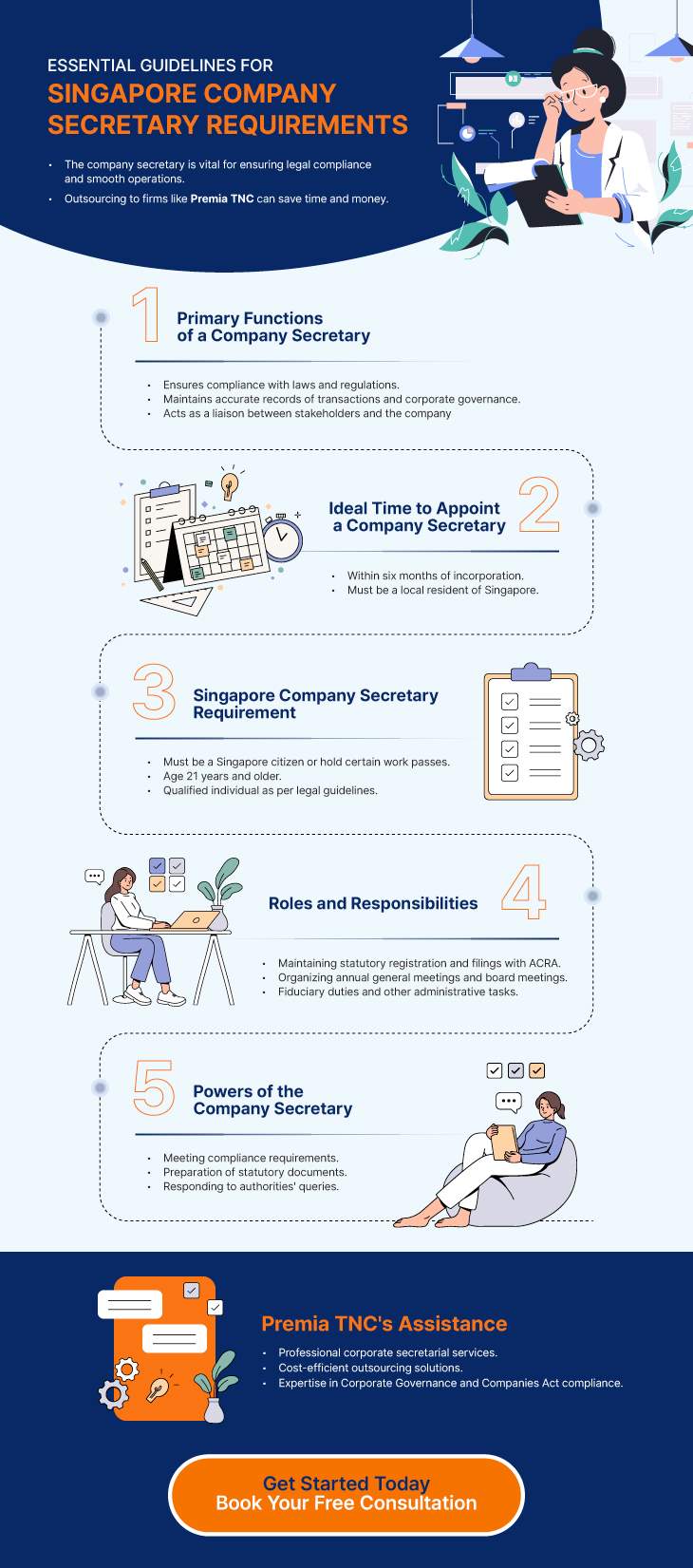

Many businesses turn to outsourced company secretarial service providers like Premia TNC because it helps them save more time and money than hiring and training an in-house secretary.

Read on to find out more about the essential Singapore company secretary requirements and whether you should use outsourced services.

Singapore Company Secretary Requirements: Primary Functions

The main role of a Singapore Company Secretary is to ensure that the company complies with all the applicable laws and regulations. This affects the Singapore company secretary requirements as the candidate must be qualified to carry out the required duties and responsibilities.

In addition, they are responsible for maintaining accurate records of business transactions, ensuring that the company follows its constitution, and that directors carry out their duties in an effective manner.

The company secretary ensures that all relevant legislative duties are met, corporate governance standards are upheld, and that a regular presence is maintained at the company’s registered office address.

In terms of company shareholders, the company secretary should communicate with them regularly and protect their interests; immediately disseminating financial information so that shareholders can partake in decision-making at the company’s Annual General Meeting.

The secretary’s responsibilities to company directors include serving as an advisor on statutory and governance matters, providing practical assistance as needed, and ensuring that all directors receive timely information to facilitate their full engagement during board meetings

Singapore Company Secretary Requirements: Who Cannot Serve as a Company Secretary

Restriction on Sole Directors

Singapore Company Secretary Requirements specify that the sole director of a company cannot act as the company secretary. This separation of roles is intended to prevent conflicts of interest and ensure that corporate statutory duties, such as maintaining accurate records and facilitating board decisions, are properly managed. By requiring different individuals to fill these roles, companies are better positioned to comply with regulatory obligations and maintain effective governance.

Regulatory Disqualifications

Individuals disqualified by regulatory authorities, such as the Accounting and Corporate Regulatory Authority (ACRA), are also ineligible. Disqualification may result from prior breaches of company law or failures to meet statutory obligations. These measures maintain the integrity of company secretarial roles and reinforce the importance of competent administration in Singapore’s business environment.

Singapore Company Secretary Requirements: The Ideal Time to Hire

In Singapore, incorporating a company necessitates the appointment of a company secretary within six months of incorporation, as mandated by the Accounting and Corporate Regulatory Authority (ACRA). The appointed secretary must be a local resident of Singapore and cannot be the sole director of the company; however, a locally resident director may serve as both director and secretary if the company has multiple directors.

Singapore Company Secretary Requirements: Timeline and Compliance

Mandatory Appointment Period

To ensure that corporate governance mechanisms, such as maintaining statutory registers and filing annual returns, are operational from the outset, companies incorporated in Singapore are required to appoint a qualified company secretary within six months of incorporation. This timely appointment also equips directors with essential administrative support to carry out their duties efficiently.

Handling Vacancies

A replacement must be appointed within six months if the company secretary resigns or the position becomes vacant. Maintaining continuity in this role is critical for ongoing compliance with statutory obligations and the smooth operation of corporate governance processes. Delays in filling the position may disrupt administrative functions and increase the risk of non-compliance.

Consequences of Non‑Compliance

By understanding these timelines and responsibilities, directors can foster a culture of accountability within the organization and ensure compliance with the Companies Act. Failing to appoint a company secretary on time may lead to penalties, fines, or other legal consequences and can also impact the company’s credibility and governance standing with regulators and investors.

Singapore Company Secretary Requirements

So, what exactly are the Singapore company secretary requirements? Before getting into the criteria for choosing a suitable candidate, you must first understand how the role of the company secretary is defined.

A company secretary is a person with the qualifications and experience to ensure the company complies with statutory and regulatory requirements and supports good corporate governance. A company secretary is appointed by the board of directors or shareholders and can be removed from office at any time by them.

Thus, due to the Singapore company secretary requirements, the company secretary is usually a lawyer, accountant, or business executive.

According to the Companies Act, Section 171 (1AA), Singapore company secretary requirements for public companies must meet the following criteria:

- Natural person who is ordinarily resident in Singapore

- EntrePass holder or Employment Pass holder issued with such a pass may work at the company in question. (Note: S pass holders can also serve as company secretaries. However, they are not permitted to serve as company directors.)

- Age 21 years old and above

- Has been a company secretary of a company for at least three of the five years immediately before his appointment as company secretary of the public company

- Qualified individual as defined by the Legal Profession Act (Cap. 161)

- Public accountant licensed by the Accountants Act (Cap. 2)

- Member of the Institute of Certified Public Accountants of Singapore

- Member of the Singapore Association of the Institute of Chartered Secretaries and Administrators

- Member of the Association of International Accountants (Singapore Branch)

- Member of the Institute of Company Accountants, Singapore

Meanwhile, the Companies Act specifies who is not eligible to be selected for a company’s secretary position. The exclusions are as follows:

- In Singapore, the sole director of a corporation cannot function as the company secretary but can appoint a corporate service provider to do so.

- A person who has been barred from being appointed may also be denied. This indicates that a practicing company secretary whose right to function as corporate secretary has been revoked, may also be disqualified.

Singapore Company Secretary Requirements: The Key Role

The Company Secretary in Singapore plays a pivotal role in ensuring statutory compliance, safeguarding the company’s interests, and fostering good corporate governance. This involves overseeing all regulatory obligations, maintaining the company’s registered office, and upholding corporate governance standards. Additionally, they serve as a trusted advisor to directors, providing practical support and facilitating informed decision-making by sharing timely information.

Singapore Company Secretary Requirements: Duties and Responsibilities

The Singapore company secretary requirements are put in place because of the extensive job scope the role covers. The Singapore Company Secretary is a position that is responsible for the general administration duties of the company, specifically the following:

1. Maintaining Statutory Registration

The Company Secretary is responsible for maintaining and updating the statutory registers required by law, including:

- Register of Members

- Register of Nominee Directors

- Register of Company Charges

- Register of Directors, Secretaries and Auditors

- Register of Controllers

- Minutes book

2. Filings with the Accounting and Corporate Regulatory Authority (ACRA)

The company secretary is in charge of all ACRA filings, which include, among other things:

- Notifications of appointment, removal, and resignation of directors, CEOs, corporate secretaries, and auditors

- Creating and submitting annual returns

- Changing the name of a firm

- Changes in share capital

3. Annual general meetings

The secretary must prepare and distribute shareholder meeting notices. They should also make meeting agendas and distribute financial reports.

4. Board meetings

The company secretary must inform directors about the issues that will be considered during the meeting. They should also prepare and disseminate the relevant information and documentation. Additionally, they take minutes, prepare board resolutions, and authenticate copies of minutes.

5. Fiduciary Duties

ACRA considers a company secretary to be an officer of the company, enforcing the same fiduciary duties as company directors:

- Always behave in the company’s best interests, avoid conflicts of interest, and carry out responsibilities with acceptable care and diligence.

- Never profit illegally from personal deals for/with the company.

6. Other duties

The Singapore company secretary should, if necessary, maintain proper custody and use of the company seal, if available. They also manage correspondence between shareholders and the company. Furthermore, they must remind the directors to complete their statutory tasks on time and ensure the company’s operations are transparent and accountable.

Singapore Company Secretary Requirements: Primary Functions

In Singapore, the company secretary is an officer of the company required by law to be appointed. The company secretary has a wide responsibilities and duties, which include:

- Meeting of compliance requirements;

- Preparation of statutory documents, e.g., AGM, EGM and Directors’ Resolutions;

- Providing information on behalf of the company in response to queries from various authorities;

- Maintaining records related to company formation, administration, and dissolution.

When establishing a business in Singapore, it is recommended that you hire a competent firm such as Premia TNC, ensuring compliance with Singapore company secretary requirements.

Singapore’s corporate secretarial services are all about ensuring a company’s compliance with legislative and regulatory obligations. All registered companies in Singapore are required by law to have a company secretary who will assist and guarantee compliance with the Singapore statutory framework.

Premia TNC provides high-quality corporate secretarial services in Singapore to meet all of your regulatory requirements. If you’re an entrepreneur looking to establish a company in Singapore, Premia TNC can assist you with all aspects of corporate secretarial services in Singapore. Contact us now for a consultation!

Singapore Company Secretary Requirements: Common Misconceptions

Sole Director Serving as Secretary

A frequent misconception is that the sole director of a company can also serve as its company secretary. Singapore law explicitly prohibits this arrangement to ensure a separation of statutory responsibilities and to safeguard effective governance. Directors should be aware that appointing a separate company secretary supports accountability and reduces the risk of non-compliance.

Eligibility of Non‑Citizens

Contrary to popular belief, company secretaries do not need to be Singapore citizens. Non-citizens who are ordinarily resident in Singapore, including permanent residents or those holding valid employment or dependent passes, are eligible to serve. This flexibility allows companies to access a wider pool of skilled professionals with the experience and knowledge necessary for statutory compliance.

Qualification Requirements

Some assume that professional qualifications are mandatory for all companies. While public companies are required to appoint secretaries with recognized professional credentials, private companies may appoint individuals with sufficient knowledge and experience to manage statutory obligations. This includes maintaining registers, preparing meeting agendas, and ensuring accurate record-keeping. Clarifying these misconceptions helps companies make informed decisions about corporate governance while remaining compliant with Singapore law.

Premia TNC’s Assistance

Let us assist you by providing professional corporate secretarial services. Under Singapore law, it is mandatory to appoint a company secretary, and with Premia TNC, you are looking to benefit from cost-efficient outsourcing solutions, ensuring compliance with regulatory requirements.

Our experienced team offers expertise in Corporate Governance and the Companies Act, guaranteeing peace of mind while establishing and maintaining your business entity. By partnering with us, you gain access to a range of services tailored to meet your evolving business needs, all while benefiting from our extensive industry experience.

FAQs

1. What are the Singapore company secretary requirements for appointment?

Hiring must be done within six months of the company's startup. They must be a natural person ordinarily resident in Singapore and possess the necessary knowledge and experience. Importantly, the secretary cannot be the sole director.

2. What are the core duties of a company secretary in Singapore?

Responsibilities include maintaining statutory records, filing annual returns, ensuring compliance with regulations, and advising on corporate governance matters.

3. Can a company secretary in Singapore be a foreigner?

Yes, as long as they are ordinarily resident in Singapore, holding a valid employment pass or similar residency status, and have a good understanding of local corporate laws and regulations.