Singapore company resolutions play a crucial role in post-company registration compliance and hold significant influence over business operations in the country. These resolutions include formal decisions regarding the company’s constitution, types of resolutions such as shareholders’ and board of directors’ resolutions, voting rights agreements, and the distinction between public and private companies’ notice periods for board meetings. Ordinary and special resolutions, typically passed by shareholders, may also be held at shorter notice if members agree, and Section 157A of the Companies Act outlines the requirements for such resolutions to be passed. Additionally, the allocation of voting rights and the share capital play a vital role in determining how resolutions are structured. In this article, we will be taking a closer look at what makes Singapore company resolutions tick.

What do Singapore company resolutions consist of?

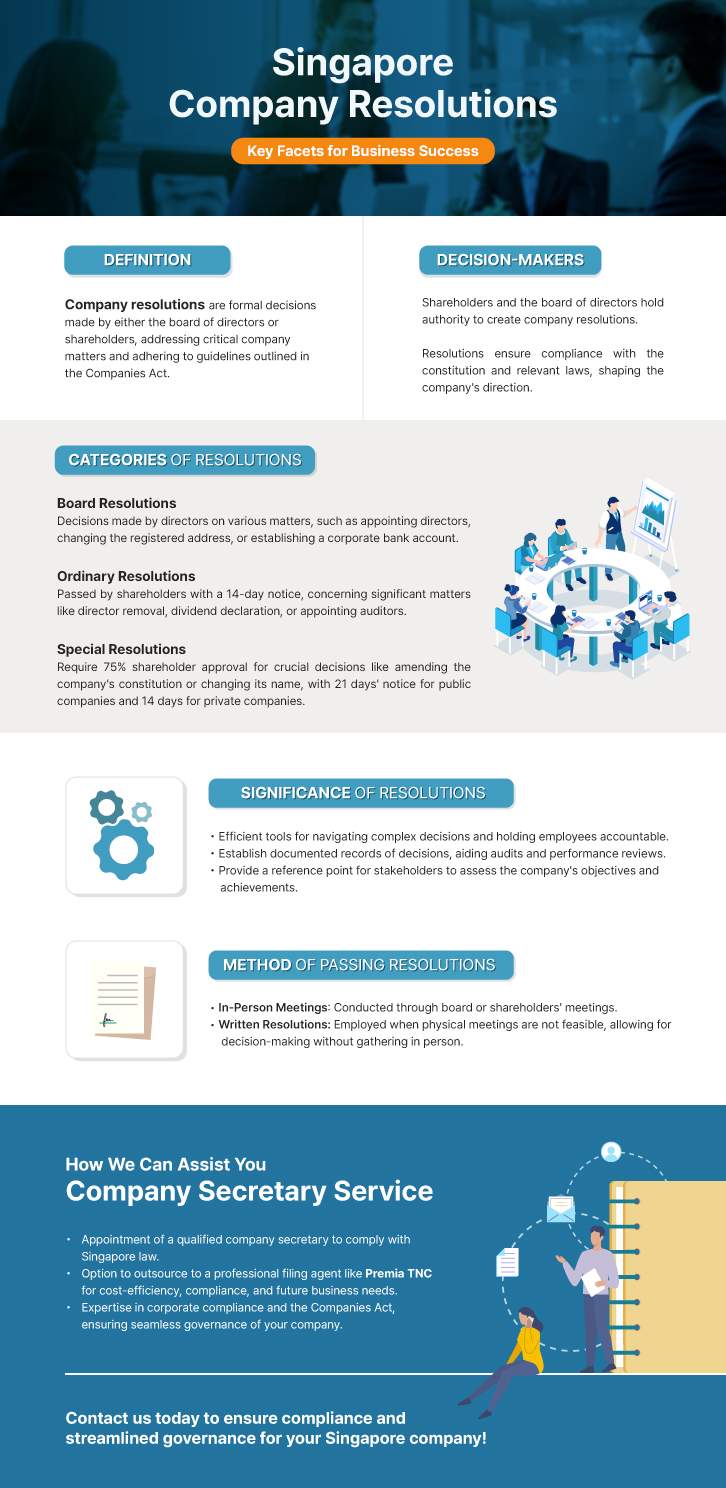

A company resolution is an official decision reached during meetings of either the board of directors or shareholders, addressing critical company matters. These resolutions must adhere to the guidelines outlined in the Companies Act, and a resolution is deemed passed when it receives majority support through voting.

Who holds the authority to create Singapore company resolutions?

Key decision-makers for company resolutions in Singapore are shareholders and the board of directors. Shareholders can pass written, ordinary, and special resolutions, while directors make collective decisions through board meetings or written resolutions. The process is regulated by specific notice periods and requirements detailed in the Companies Act, ensuring formal and legally binding outcomes for various company types, including public and private companies. These resolutions play a vital role in the governance and decision-making processes, shaping the company’s direction and ensuring compliance with the constitution and relevant laws.

A look at the 3 categories of Singapore company resolutions

The choice of a specific company resolution type is largely dictated by the Companies Act and the company’s constitution, with three distinct categories available.

Board Resolution

According to Section 157A of the Companies Act, directors have the authority to make all company decisions, unless specific instances outlined in the Companies Act or the company’s Constitution require shareholder involvement. In such cases, formal decision-making through a board resolution is necessary. Examples of decisions where a board resolution can be passed in compliance with the Companies Act include:

- Establishing a corporate bank account and designating authorized employees for transactions.

- Appointment of an audit committee.

- Changing the registered address.

- Appointing or resigning directors and company secretaries.

Ordinary Resolutions

Shareholders of a company pass ordinary resolutions, which require a 14-day notice to all members before the meeting. These resolutions are approved when a majority of 50% of shareholders agree to the formal decision, and the meeting may also proceed if members with 95% of the voting rights consent.

Ordinary resolutions are decided by a simple poll or raising of hands, with the majority determined by the number of members voting, excluding proxies or abstentions.

Here are examples of situations where ordinary resolutions are significant:

- Removal of a director before the term’s expiration.

- Determining whether a general meeting is the Annual General Meeting (AGM).

- Appointment or re-appointment of a director over the age of 70.

- Declaration of dividends.

- Hiring and setting auditors’ remuneration.

- Election of new directors to replace retiring ones.

- The allotment of shares.

Special Resolutions

A special resolution is a formal decision that necessitates approval by at least 75% of the votes cast by shareholders during a meeting. These resolutions are reserved for exceptionally important decisions. Examples of situations requiring special resolutions include:

- Amendments to any provision in the company’s constitution.

- Changing the company’s name.

To facilitate special resolutions, public companies are required to provide 21 days’ written notice for the meeting, while private companies must give 14 days’ notice. After the special resolution is passed, the company must lodge a copy of all special resolutions with ACRA.

The significance of Singapore company resolutions

Resolutions serve as efficient tools for companies to swiftly navigate complex decisions, saving time and streamlining processes. They enable shareholders and the board of directors to hold employees accountable and provide crucial direction when needed. Additionally, resolutions establish a documented record of past decisions, aid in audits and performance reviews, and offer a reference point for stakeholders when assessing the company’s objectives and achievements.

Methods of passing Singapore company resolutions

Company resolutions in Singapore can be passed through two primary methods:

- In-Person Meetings: Companies can pass resolutions through board meetings for board resolutions and shareholders’ meetings for shareholders’ resolutions.

- Written Resolutions: When physical meetings are not feasible, written resolutions may be employed. According to Section 184D of the Companies Act, a physical meeting can be requested by individuals with at least 5% voting rights.

How are we able to assist you? – Our Company Secretary Service

When establishing a company in Singapore, you must appoint a company secretary to comply with the Singapore law. This secretary should be at least 18 years old, not the sole director, and a local resident in Singapore. Business owners have the choice to hire an in-house secretary with knowledge of corporate compliance and the Company Act, or they can opt to outsource this role to a qualified filing agent, such as Premia TNC. Outsourcing offers cost-efficiency, ensures engagement with a professional, leverages the extensive experience of agencies like Premia TNC, guarantees compliance, and fosters a relationship with a company capable of offering additional services to meet future business needs.

Singapore Company Resolutions FAQs

1. What is a Singapore company resolution?

A Singapore company resolution is a formal decision made by the company's directors or shareholders during meetings to address significant business matters.

2. How are company resolutions typically passed in Singapore?

Company resolutions can be passed either through physical meetings, where board or shareholder meetings are held, or in writing, where written resolutions are submitted and agreed upon.

3. What are the different types of company resolutions in Singapore?

There are three main types of resolutions: ordinary resolutions, special resolutions, and board resolutions, each used for different levels of importance in decision-making.

4. Do all resolutions require the same notice period in Singapore?

No, the notice period varies depending on the type of resolution and whether the company is public or private. For example, public companies generally require 21 days of written notice for special resolutions.

5. Can a written resolution be used when a physical meeting is not possible?

Yes, when holding a physical meeting is not feasible, companies can pass resolutions in writing, following specific procedures outlined in the Companies Act.