In the ever-evolving landscape of financial regulation, Malaysia takes a robust stance with its comprehensive anti-money laundering and counter-financing of terrorism (AML/CFT) measures. Enshrined in the Anti-Money Laundering, Anti-Terrorism Financing, and Proceeds of Unlawful Acts 2001 (Act 613), these measures represent the country’s unwavering commitment to upholding financial integrity. Our focus today is the significant collaboration between the Companies Commission of Malaysia (SSM) and the Central Bank of Malaysia (BNM), which was fortified on 22 August 2022. This strategic partnership aims to enhance the regulatory framework and supervision of financial operations, specifically targeting the roles of company secretaries and trust companies. Through this initiative, Malaysia is setting a benchmark in the ASEAN region for its proactive approach to preventing financial malpractices and ensuring a secure economic environment.

BNM’S Policy Documents

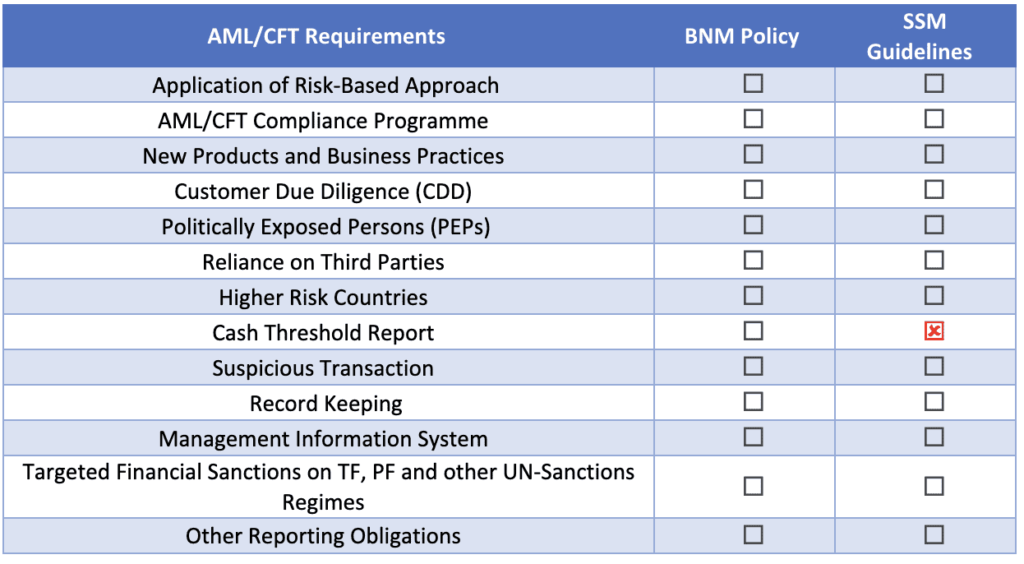

The latest policy document from BNM sets a pivotal framework for Anti-Money Laundering and Countering Financing of Terrorism, extending its reach to include Designated Non-Financial Businesses and Professions, as well as Non-Bank Financial Institutions. This comprehensive approach is further distilled by the SSM, which has tailored guidelines that delineate the specific responsibilities of Company Secretaries acting as reporting entities. These guidelines are a testament to Malaysia’s dedicated effort to fortify its financial systems against unlawful activities. The seamless policy translation from BNM’s broad directives to SSM’s specialized guidelines reflects a concerted national strategy to maintain financial integrity and combat economic crimes.

Objectives

The objectives of the SSM’s Guidelines are crucial for maintaining financial security within corporate Malaysia. They aim to clearly define the responsibilities and obligations of company secretaries under the AMLA. By doing so, these guidelines are instrumental in preventing and combating Money Laundering (ML) and Terrorist Financing (TF). Furthermore, they are designed to aid company secretaries in grasping their critical role as Reporting Institutions, advocating for a comprehensive risk-based approach to effectively manage the risks associated with ML and TF. This strategic initiative underscores the proactive steps that Malaysia is taking to safeguard its financial systems from being exploited for illicit activities.

Legal Provision

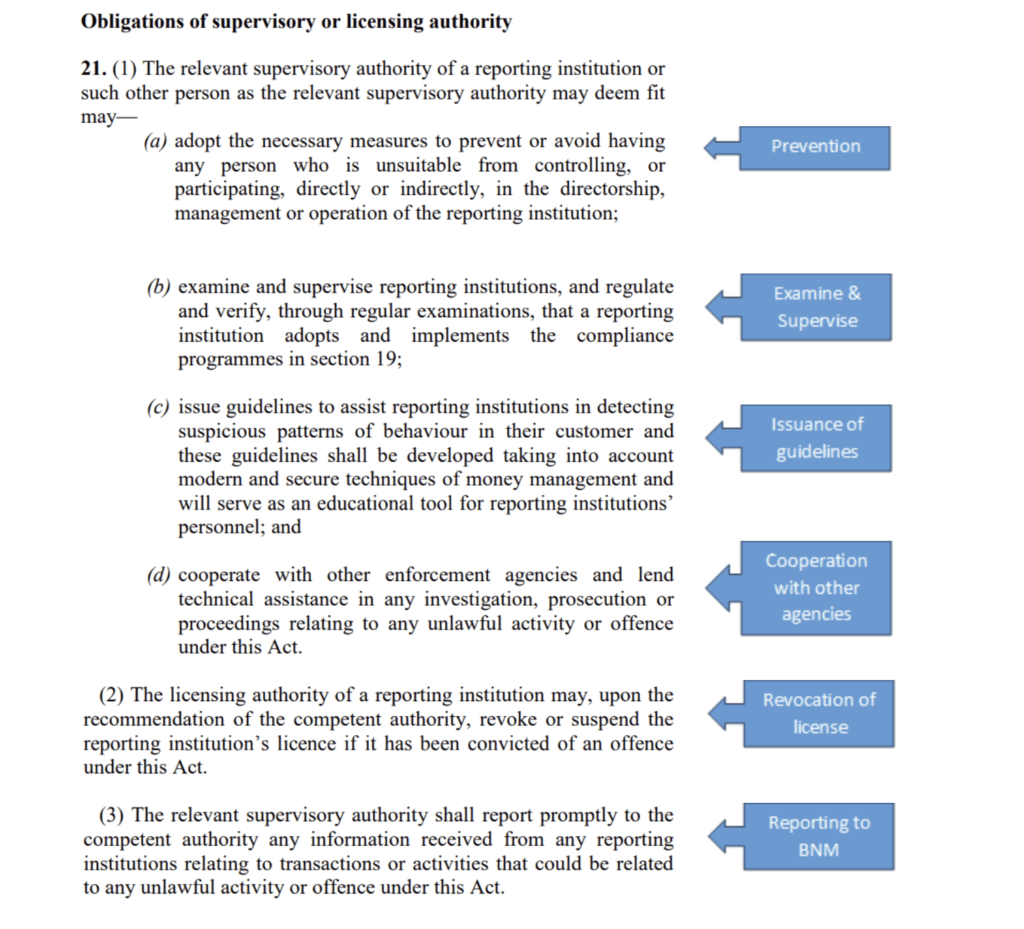

AMLA entrusts supervisory authorities like SSM with vital responsibilities to uphold legal compliance. Subsection 21(1) of AMLA, as detailed in BNM’s legal provision, mandates SSM to implement preventative measures against unsuitable individuals participating in financial institutions’ management. It outlines duties including the examination and supervision of reporting institutions, issuance of guidelines to detect and combat suspicious financial activities, and cooperation with other enforcement agencies. Additionally, it empowers SSM to recommend license revocation for non-compliant entities and necessitates prompt reporting to BNM on matters related to unlawful activities. This legal framework is central to Malaysia’s strategy to prevent ML and TF, ensuring that financial entities operate with integrity and within the bounds of the law.

Part IV Of AMLA (Reporting Obligations)

The focus shifts towards fortifying the SOAC, a pivotal component of the corporate rehabilitation framework. The enhancements are meticulously designed to dispel ambiguities surrounding the roles and obligations of insolvency practitioners, thereby instilling a sense of clarity and confidence in the process. The introduction of a moratorium period marks a strategic move to shield distressed companies from legal actions during the negotiation and restructuring phase, providing a vital breathing space for recovery efforts. Furthermore, the establishment of a rescue financing framework, coupled with the introduction of cram-down provisions, represents a comprehensive strategy to invigorate the SOAC process. These initiatives are aimed at facilitating smoother negotiations between debtors and creditors, ensuring a more equitable and efficient pathway to recovery for financially distressed entities.

Applicability

The regulations encapsulated within the AMLA are comprehensive, extending their reach to all company secretaries in Malaysia. Whether operating individually or through a firm, company secretaries are mandated to adhere to the activities detailed in paragraph 13 of the First Schedule of AMLA and paragraph 3.3(i) of the BNM Policy Document. This universal applicability ensures a standardized level of vigilance and compliance across the board, reinforcing the nation’s commitment to thwarting financial crimes and enhancing the integrity of its corporate governance structures.

Para 13 of AMLA

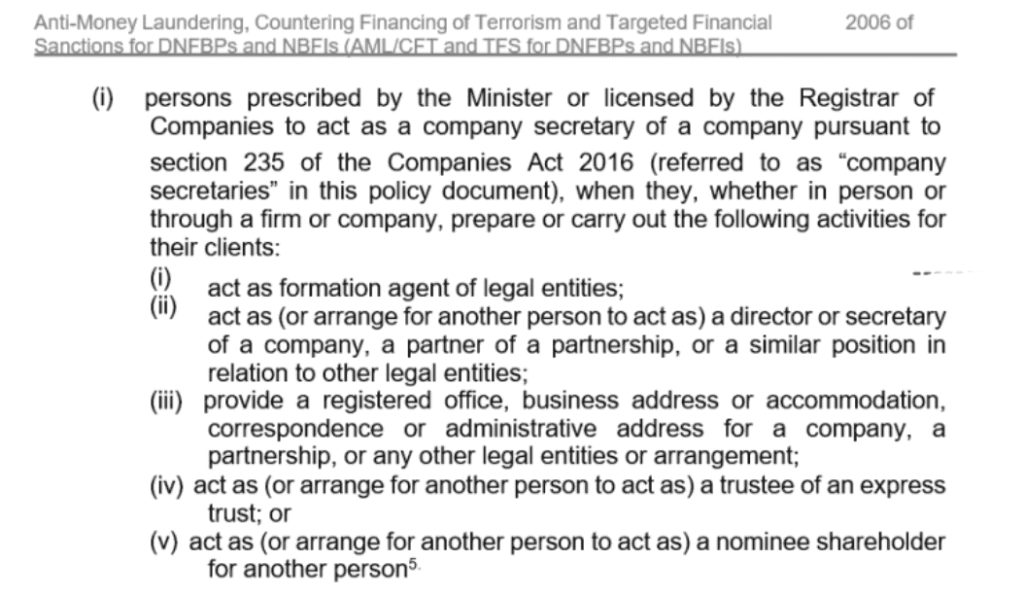

Para 3.3(i) of BNM Policy Document

AML/CFT Requirement

Terms and Definition

In the realm of corporate governance and compliance, terminology is the cornerstone of clarity and understanding. The SSM’s Guidelines for company secretaries in Malaysia are meticulously aligned with definitions provided in the Bank Negara Malaysia (BNM) Policy Document and other acts overseen by the SSM. This ensures uniformity in interpretation across all regulatory materials. However, it’s notable that certain terms used in BNM Policy Documents, such as “cash transaction”, “financial group”, “fund-in transaction”, “fund-out transaction” and “junkets”, are deliberately excluded from the SSM Guidelines. Instead, the SSM Guidelines include additional definitions tailored to their scope, including “board of a secretarial firm”, “company secretary”, and “small-sized secretarial firm”, underscoring the specific context in which company secretaries operate within the regulatory framework.

The definitions provided within the SSM’s Guidelines offer a clear understanding of the roles within the corporate regulatory environment in Malaysia.

- “Company secretary” refers to a person who is issued with a practicing certificate under section 241 of the Companies Act 2016 (CA2016). For these Guidelines, a company secretary includes any company secretary practicing through a firm or a company.

- “Secretarial firm” refers to an entity through which a company secretary offers secretarial services and is subject to reporting obligations under Part IV of the AMLA when a company secretary practicing and the firm is engaged in activities that are designated as gazetted activities.

- “Small-sized secretarial firm” refers to a secretarial firm having 5 members and/or company secretaries who have been issued with Practising Certificate under section 241 of the CA2016 by SSM.

Exemption/ Simplification

In the regulatory framework set by SSM, there is a provision for simplification and exemption specifically for in-house company secretaries.

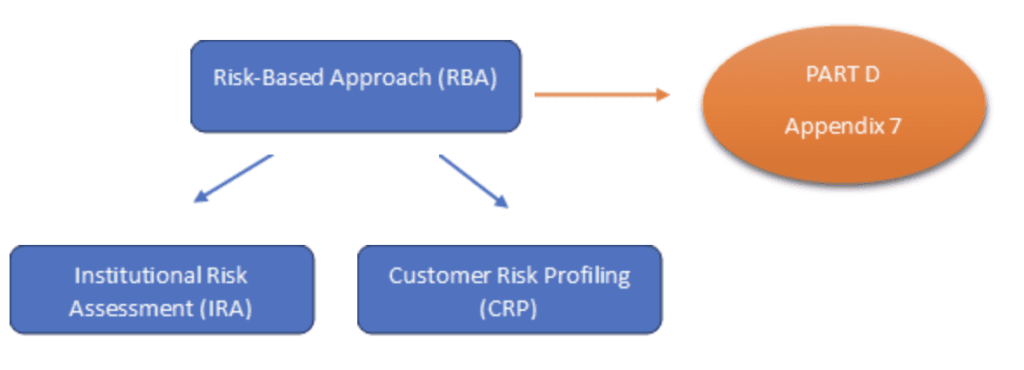

Application Of Risk-Based Approach

A company secretary or a secretarial firm is required to implement a robust framework for risk control and mitigation. This includes developing and enforcing tailored policies, procedures, and controls specifically designed to manage and mitigate the risks associated with ML and TF. They must also actively monitor the effectiveness of these implementations, take heightened measures for managing higher risk scenarios as identified by the regulatory bodies BNM or SSM, and conduct independent testing of the control mechanisms to ensure their integrity and efficacy. These steps are crucial in maintaining a stringent defense against financial crimes within the corporate sector.

AML/CFT Compliance Programme

The AML/CFT regulations require that a company secretary or secretarial firm establish and enforce internal policies, procedures, and controls tailored to their specific ML/TF risks, considering the size, nature, and complexity of their business operations. This includes the responsibility of the board and senior management to oversee compliance, as well as the implementation of compliance management arrangements, which entail the appointment of a Compliance Officer (CO) with defined duties. Additionally, the programme mandates employee screening procedures and training and awareness programmes to ensure all staff is knowledgeable about AML/CFT practices. There is also a provision for an independent audit function to regularly evaluate the effectiveness of the implemented policies and procedures.

The AML/CFT Compliance Programme is designed with scalable requirements to suit businesses of various sizes. For small-sized secretarial firms, there is an exemption or simplification in place. For instance, at a minimum, they can adopt a policy document as their policies and procedures without needing to develop their internal policies. Employee Screening Procedures are required only upon initial hiring, and Employee Training and Awareness are to be simplified, such as through on-the-job training, with certain requirements for Independent Audit Functions being exempted.

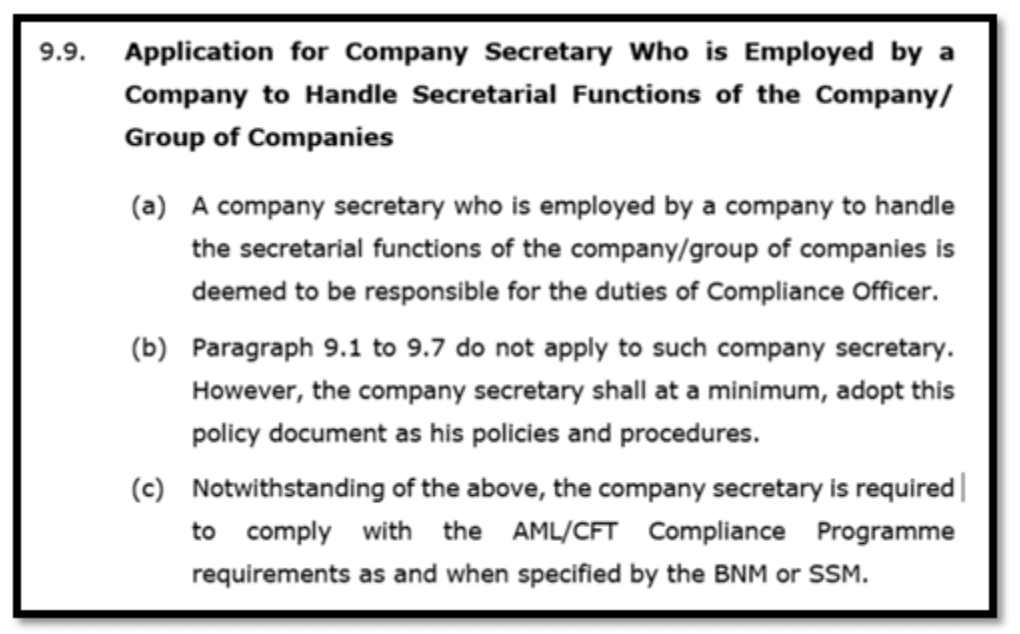

In contrast, in-house company secretaries, who handle secretarial functions for a company or group of companies, are deemed responsible for Compliance Officer duties. The duties are as follows:

- shall at a minimum, adopt the policy document as his policies and procedures.

- properly implement the appropriate AML/CFT policies and procedures

- establish and maintain relevant internal criteria (red-flags) PART E – Appendix

- promptly report STR to the FIED of Bank Negara Malaysia.

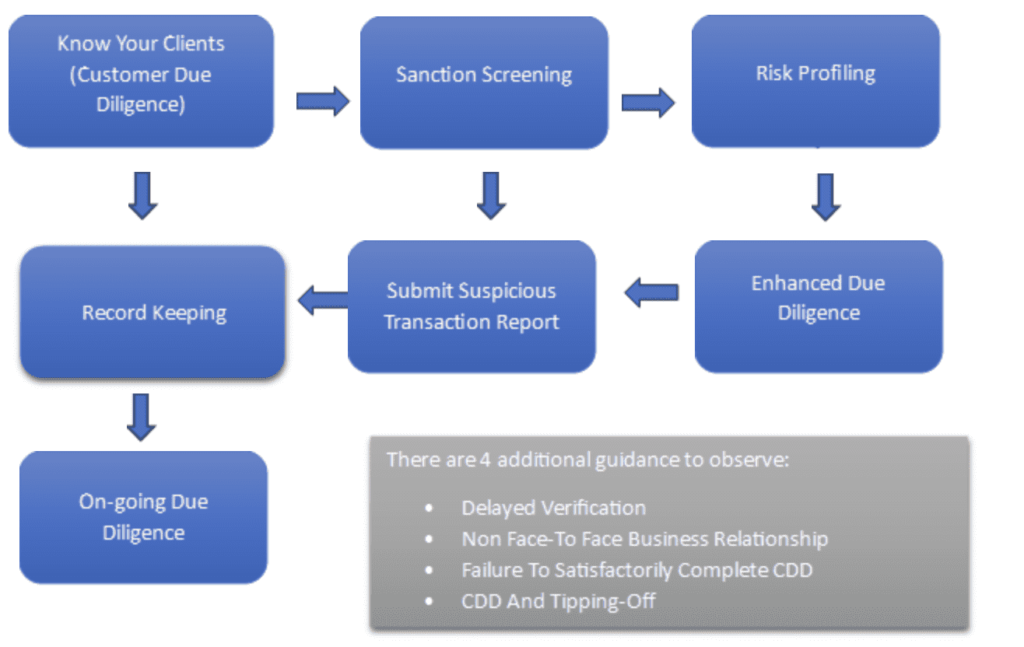

In discharging his duties, a company secretary must comply with and put in place the following key and fundamental requirements under Part IV of the AMLATFPUAA 2001:

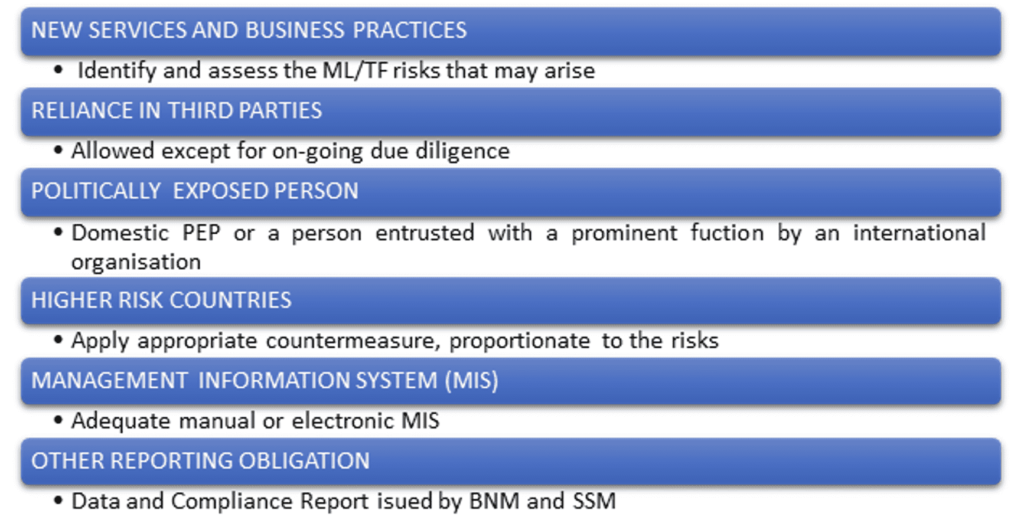

Other Matters Relating To CDD

In discharging his duties, a company secretary must comply with and put in place the following key and fundamental requirements under Part IV of the AMLATFPUAA 2001:

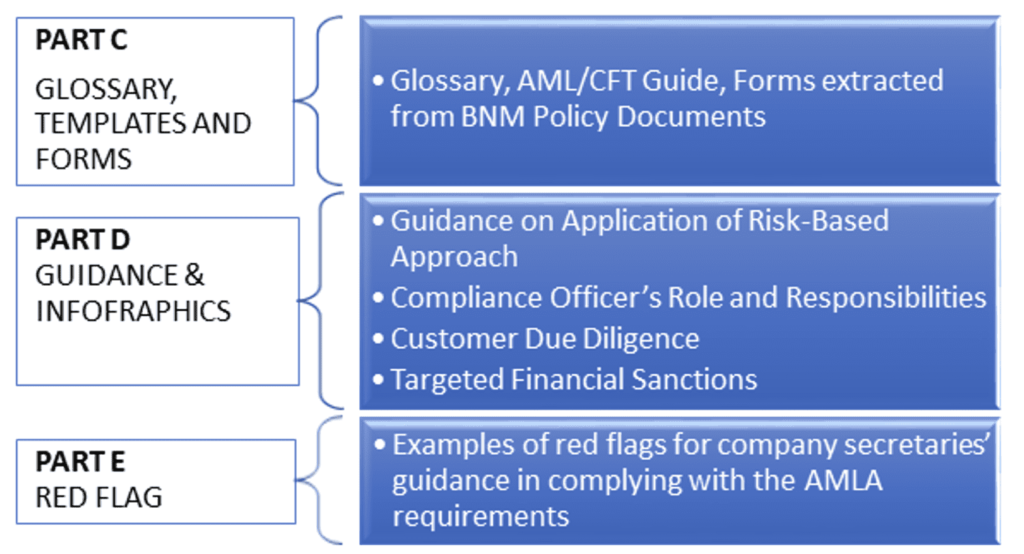

Appendix

Role of the Company Secretary in Malaysia: Conclusion

In summary, a company secretary must understand their obligations under both the CA2016 and the AMLA, ensuring full comprehension of the requirements set forth by these two distinct regulatory frameworks. Such understanding is crucial in effectively mitigating risks, preventing any entity or individual from exploiting potential system gaps, and closing loopholes in the regulatory structure. It also helps maintain the integrity of the company’s secretarial profession. Company secretaries are strongly encouraged to enhance their expertise by participating in certified AML/CFT courses provided by SSM, BNM, professional bodies, and other relevant institutions. This education will empower them to effectively fulfil their roles and responsibilities.