Singapore Company

Incorporation Services

For companies abroad wishing to establish operations, or for individuals of foreign origin seeking to set up a company within Singapore, we offer a comprehensive range of services for company incorporation. Our expertise can guide you smoothly through the intricacies of the incorporation process, from the initial set up to the selection of a local director, and beyond!

Reasons to Incorporate a Business in Singapore

The skilled professionals at Premia TNC stand ready to guide you through the process of company incorporation in Singapore, offering insightful advice on all relevant matters. For more in-depth information on Singapore’s corporate landscape, click here.

Setting up your business in Singapore offers several advantageous benefits, such as:

Benefit 1:

1. Substantial Deductions on Taxable Income

Companies established in Singapore can avail themselves of considerable tax reductions, as detailed in the following chart:

| Taxable Revenue | Percentage Exempted | Total Sum Exempted |

|---|---|---|

| Initial $10,000 | at 75% | equals $7,500 |

| Following $190,000 | at 50% | equals $95,000 |

| Cumulative $200,000 | equals $102,500 |

2. Unvarying Corporate Tax Rate

Regardless of its origins, either domestic or international, a firm is levied with a consistent tax rate of 17% on its taxable revenue.

3. Non-Taxable Status of Income Sourced Abroad

Three distinct categories exist for specified income from foreign sources, which are:

- Dividends from foreign sources;

- Profits from foreign branches; and

- Income from services sourced overseas.

A company that is a tax resident of Singapore can benefit from tax exemptions on its defined foreign income that has been transferred into Singapore.

As per Clause 13(9) of the Income Tax Act, tax exemptions are provided when all three of the ensuing conditions are satisfied:

- The income from foreign sources has been subject to taxation in the foreign country where it was received (termed as the “subject to tax” provision). The tax rate applied to the foreign income may differ from the principal tax rate;

- The paramount corporate tax rate (foreign principal tax rate condition) in the foreign country where the income has originated is not less than 15% when the foreign income arrives in Singapore; and

- The Tax Controller concurs that the tax exemption would be advantageous to the person who is a resident in Singapore.

Benefit 2:

Singapore’s rigorous enforcement of its robust intellectual property laws provides a secure shield for your innovative concepts and breakthroughs.

Benefit 3:

Elevated brand credibility achieved by having a parent company in Singapore, which significantly bolsters trust among global clients, customers, and investors.

Benefit 4:

Singapore’s standing in various global rankings underlines its conducive business environment.

- The World Bank acknowledges it as one of the most politically stable nations.

- INSEAD rates it highly on the scale of global talent competitiveness.

- Forbes recognises it as one of the best countries for conducting business.

- The World Bank rates it as the second-easiest place to conduct business.

- The World Economic Forum ranks it as the second most competitive economy in the world.

Benefit 5:

Impressive International Framework of Accords:

- Dual Taxation Treaties

- Investment Assurance Contracts

- Free Commerce Pacts

- Economic Alliance Agreements

Benefit 6:

A company that has fulfilled all registration requirements in Singapore obtains a business structure that is legally independent, separate from its shareholders and directors.

Benefit 7:

Absence of Dividend and Capital Appreciation Taxes

Benefit 8:

Simplified Business Establishment – A corporation can be formed without a physical footprint in Singapore, often being registered within a single day.

Benefit 9:

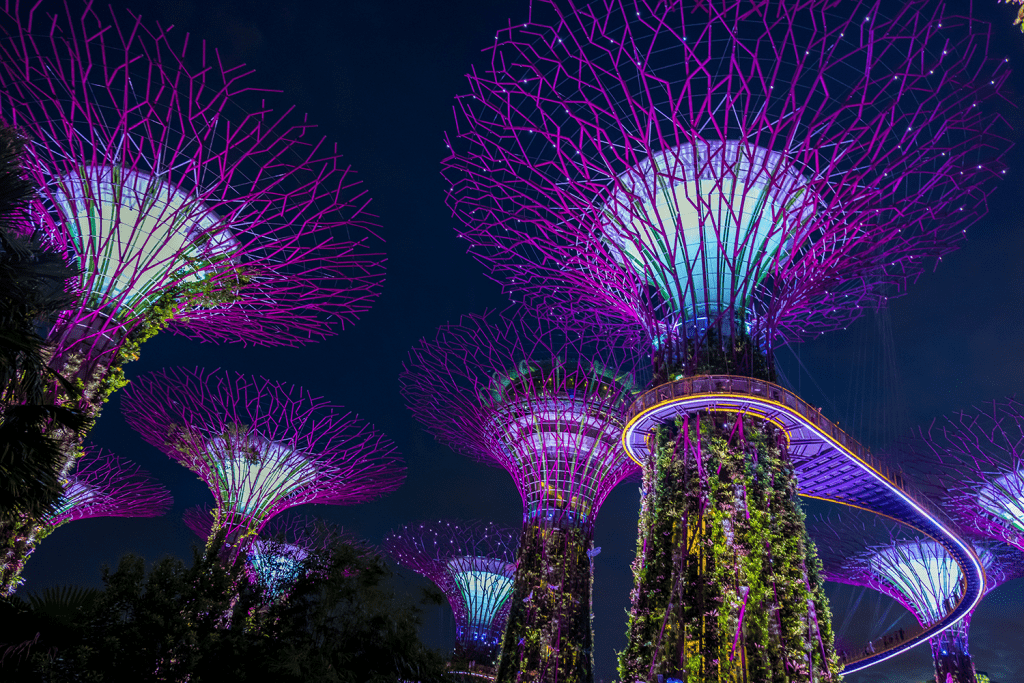

Superior Living Standards – Singapore is renowned for its safety, greenery, clean surroundings, exceptional healthcare, and high-quality education. It further boasts a top-notch support network for businesses, entrepreneurs, and corporations.

Benefit 10:

Modern and Sophisticated Infrastructure and Transport Systems

Benefit 11:

Educated, Skilled Workforce & Inclusive Immigration Policies

Benefit 12:

Strategic Position – With its central location on international shipping routes, Singapore benefits from having one of the busiest and largest seaports in the world, complemented by outstanding airport facilities.

Important Tips and Advice for New Company Registration in Singapore

Whether you’re based overseas or considering setting up an offshore enterprise, registering your company in Singapore offers numerous advantages such as:

- Its prime strategic location coupled with a robust and globalised economy renders Singapore a desirable and exceptional business hub for organisations looking to expand their reach in Southeast Asia and the Asia-Pacific region.

- If you’re contemplating doing business in Singapore, it’s an ideal opportunity as understanding the investment environment and gaining knowledge about the legal, accounting, and taxation structure are crucial for steering your organisation towards a leading position.

- A Private Limited Company is the most prevalent type of business entity in Singapore. This guide offers a wealth of insights into key facets of investing and conducting business in Singapore, highlighting some common challenges companies might face during their expansion into this city-state.

- A private limited company in Singapore is characterised by share limitation and operates as a distinct legal entity from its shareholders. It’s recognised as a taxable entity in its own right, which means the shareholders of a Singapore private limited company are only responsible for its debts and losses up to their share capital amount.

Incorporating a Company in Singapore Prerequisites:

Every business in Singapore must be registered with the Accounting & Corporate Regulatory Authority (ACRA) and must comply with the Companies Act. The following guide will help simplify the process of incorporating a company in Singapore:

Selection of a Company Name

For anyone intending to conduct business in Singapore, it’s a statutory requirement to register the business with ACRA.

The first stage in registering a local company involves choosing a company name and submitting a name application via ACRA’s online portal for business registration and filing.

The company name you propose shouldn’t be identical to any existing name, nor should it incorporate any restricted or objectionable words.

While submitting a name application, you are required to identify the activities of your business by selecting the most appropriate Singapore Standard Industrial Classification (SSIC) code.

Upon the approval of your application, you can move forward with incorporating your company. The incorporation must be accomplished within 120 days from the date the name is approved.

Determining the Financial Year Closure Date

The financial year-end (FYE) of a company marks the conclusion of its accounting period, which is a recognised span needed to complete a business accounting cycle. This periodicity offers insights into the business’s profitability on a consistent basis. All transactions are documented within this period and presented in a financial statement.

The accounting period can span 12 months or over 52 weeks. For instance, if you opt for a 12-month accounting period commencing on 1 January 2020, your company’s FYE will fall on 31 December 2020. However, if a 52-week accounting period starting on Wednesday, 1 January 2020 is your choice, your company’s FYE will land on Wednesday, 30 December 2020.

Establishing the FYE is crucial as it will dictate the schedule for your corporate filings and annual tax obligations. Private companies are mandated to conduct their annual general meetings (AGM) within 6 months and submit their annual returns within 7 months following the FYE to adhere to compulsory corporate compliance standards.

Examples

In case the FYE of the company is 31 December 2020, the deadlines for conducting their annual general meetings (AGM) and submitting their annual returns (AR) will be:

- AGM is to be held 6 months after FYE, by 30 June 2021

- AR is to be submitted 7 months after FYE, by 31 July 2021

Annual Obligations You Must Fulfill

Company directors are obligated to meet certain statutory requirements as stipulated by the Companies Act. Failure to comply with these mandates can lead to enforcement action. Key statutory requirements include conducting annual general meetings and submitting annual returns.

Financial Statement Preparation

The company is required to compile and finalize their financial statement during the specific financial year-end.

Annual General Meeting (AGM)

Unless granted an exemption, your company must conduct an annual general meeting (AGM). The AGM serves as a medium to keep your company’s stakeholders informed about the company’s financial status and strategic direction. It also facilitates a dialogue between stakeholders and company officers at least once annually.

Annual Submission (AR)

Private enterprises are required to complete their annual submission within a 7-month period following the end of their financial year.

Submitting your company’s annual return in a timely manner assures accurate and punctual disclosures to all interested parties. Every company, including those inactive or dormant, is obligated to submit annual returns. Provided your company’s status is still marked as “active”, you must provide us with its annual return even if your company is exempted from filing its income tax return by IRAS.

Please be cognizant that any failure to meet these compliance requirements could result in enforcement measures against company directors who fail to conduct AGMs and submit annual returns:

- Late fines directed at both companies and directors for lapses in annual returns filing

- Proposals of a composition amount or initiation of legal action

- Termination of companies that neglect to submit ARs

- Issuance of a Debarment Order

Designating Directors, Company Secretary, and Other Vital Positions

In Singapore, the organizational structure of a private limited company mandates the following:

a. Director

At least one director, who must be ordinarily residing in Singapore (such as a Singaporean, a Permanent Resident of Singapore, or a holder of a Singapore employment pass) is required.

If there’s no local director, we can offer a nominee director service for the purpose of registration.

b. Shareholder

At least one individual shareholder or a corporate entity is needed. (the shareholder isn’t required to be a local resident, meaning the company can be entirely foreign-owned).

c. Company Secretary

A company secretary who is ordinarily resident in Singapore is necessary.

Moreover, if you are employing the services of our local nominee director, your company must designate at least one director who will manage and run the company.

The shareholder of the company will be regarded as the ultimate beneficial owner of the company.

Equity Capital

For a company to be registered, a minimum of $1.00, in any desired currency that aligns with the company’s principal business transactions (e.g., USD, SGD, EUR), is required.

A share signifies a shareholder’s fraction of the company, received in return for their financial investment in the company’s equity capital. A share can either be fully paid or partially paid.

Investing in shares translates into acquiring a partial stake in a company. A shareholder can be an individual, another business, or a limited liability partnership. It isn’t necessary for the shareholder to be a local resident, and foreign entities can wholly own the company.

Varieties of Stock

Corporations might distribute a diversity of stock options due to a range of reasons. Typical motivations encompass:

- Limiting the company’s authority to specific individuals

- Proposing stock options with priority dividend rights to stimulate investment

- Possessing distinct claims on corporate funds should the business liquidate

- Aligning with the distinct requirements and inclinations of assorted investors

Common Stock - the prevalent type

Common stocks are predominantly the standard type of stock options. These stocks generally offer voting rights and shareholders are entitled to dividends, but only once the owners of preference stocks have received their dividend payments.

Businesses may categorize their common stocks into diverse classes (for example, “Class A” and “Class B”) each having unique rights associated with them.

Local Business Address Registration in Singapore

When applying for a company incorporation in Singapore, it’s mandatory for the company to specify a local business address. This address will act as the central point for all company communications and notifications. It’s also the location where all company records and registers are preserved.

In circumstances where you’re uncertain about establishing a physical presence in Singapore, we, as your trusted corporate service facilitators, can assist by registering the company using our local office address. This registered office address can be modified in the future based on your preferences.

Specifications for Registered Office Addresses

It’s essential for all companies to keep their registered office accessible and open to the public for at least three hours during standard business hours on each workday. A workday does not include Saturdays, Sundays, and public holidays.

This specification exists to ensure that the public has the ability to connect with the office if required, and to simplify the delivery of any legal paperwork. Non-compliance with this requirement by companies or directors may lead to a fine of up to S$5,000.

The registered office must have an address in Singapore, but it’s not necessary for it to be the main operational base. For example, your company’s registered office address might be situated in Central Singapore, while your production unit could be based in the West.

Constitution

The constitution serves as a legal manuscript delineating the regulations governing the functioning of the company.

It outlines the entitlements and obligations of the directors, shareholders, and the company secretary.

The constitution must encapsulate the subsequent information:

- Name of the company and its registered office address

- Operational activities and their execution strategies

- Responsibilities borne by the company’s members

- Cumulative share capital and the tally of issued shares

- Administrative rules and regulations

Upon incorporating your business in Singapore, you need to provide a copy of your company’s constitution. Any modifications to the constitution necessitate the company to enact a special resolution at a general meeting. A copy of this special resolution, along with a copy of the amended constitution, needs to be presented to ACRA by submitting a “Notice of Resolution” through BizFile+ within a 14-day time frame.

Additional Crucial Details

Here’s a compilation of vital and handy data that newly appointed company directors should bear in mind:

Corppass

Corppass acts as a recognized digital signature for companies and other organizations (including non-profits and associations), enabling them to perform online interactions with Government departments. Administered by the Government Technology Agency (GovTech), Corppass has been the sole login method for Government-to-Business (G2B) transactions since 1 September 2018.

Effective from 1 Sep 2018, Corppass will be necessary for all Singapore registered entities having a Unique Entity Number (UEN) for government transactions.

Your designated corporate service facilitator should be able to help with establishing and managing your company’s Corppass account post the incorporation of your company, if needed.

Association with Singapore Business Federation (SBF)

As per the SBF Act, all local firms (registered under the Companies Act) with a total paid up/authorized share capital of S$0.5 million and above automatically become statutory members of SBF. If your company fulfills these prerequisites, SBF will inform you of your company’s membership.

Maintenance of Singapore Company Registers

The Companies Act necessitates all companies to keep up-to-date records of individuals in the ensuing roles:

- Members, often synonymous with shareholders

- Directors

- Secretaries

- Auditors

- CEOs

- Controllers, often known as beneficial owners

Except for the register of members for public companies, these records are preserved electronically by ACRA. Any alterations in the appointments or details of directors, secretaries, auditors, and CEOs must be updated via BizFile+ within 14 days from the date of the change. If there are modifications to the company’s shareholders or share capital, the suitable share-related transactions should be filed via BizFile+.

All registers, excluding the Register of Registrable Controllers, are accessible to the public. This facilitates commercial and business interactions, boosts transparency, and allows the public to conduct due diligence on business entities and the individuals managing them.

Please reach out to your assigned corporate service provider for any changes.

Register of Registrable Controllers

All companies incorporated in Singapore, barring a few exemptions, are obliged to establish and maintain a register of registrable controllers (RORC) within a month from the incorporation date. A controller, often referred to as the beneficial owner, is an individual or a legal entity that holds significant interest or control over a company. This mandate enhances transparency over the corporate ownership and control structure within the company.

Your company’s RORC can be held either at your officially registered business location or at the premises of your sanctioned corporate service provider.

Annual Obligations You Must Fulfill

Company directors are obligated to meet certain statutory requirements as stipulated by the Companies Act. Failure to comply with these mandates can lead to enforcement action. Key statutory requirements include conducting annual general meetings and submitting annual returns.

Financial Statement Preparation

The company is required to compile and finalize their financial statement during the specific financial year-end.

Annual General Meeting (AGM)

Unless granted an exemption, your company must conduct an annual general meeting (AGM). The AGM serves as a medium to keep your company’s stakeholders informed about the company’s financial status and strategic direction. It also facilitates a dialogue between stakeholders and company officers at least once annually.

Annual Submission (AR)

Private enterprises are required to complete their annual submission within a 7-month period following the end of their financial year.

Submitting your company’s annual return in a timely manner assures accurate and punctual disclosures to all interested parties. Every company, including those inactive or dormant, is obligated to submit annual returns. Provided your company’s status is still marked as “active”, you must provide us with its annual return even if your company is exempted from filing its income tax return by IRAS.

Please be cognizant that any failure to meet these compliance requirements could result in enforcement measures against company directors who fail to conduct AGMs and submit annual returns:

- Late fines directed at both companies and directors for lapses in annual returns filing

- Proposals of a composition amount or initiation of legal action

- Termination of companies that neglect to submit ARs

- Issuance of a Debarment Order

Important Tips and Advice for New Company Registration in Singapore

Whether you’re based overseas or considering setting up an offshore enterprise, registering your company in Singapore offers numerous advantages such as:

- Its prime strategic location coupled with a robust and globalised economy renders Singapore a desirable and exceptional business hub for organisations looking to expand their reach in Southeast Asia and the Asia-Pacific region.

- If you’re contemplating doing business in Singapore, it’s an ideal opportunity as understanding the investment environment and gaining knowledge about the legal, accounting, and taxation structure are crucial for steering your organisation towards a leading position.

- A Private Limited Company is the most prevalent type of business entity in Singapore. This guide offers a wealth of insights into key facets of investing and conducting business in Singapore, highlighting some common challenges companies might face during their expansion into this city-state.

- A private limited company in Singapore is characterised by share limitation and operates as a distinct legal entity from its shareholders. It’s recognised as a taxable entity in its own right, which means the shareholders of a Singapore private limited company are only responsible for its debts and losses up to their share capital amount.

Frequently Asked Questions

Not at all, you can remotely establish a company provided you submit all necessary documents as required by your chosen professional service provider.

The list of required documents may vary depending on your chosen professional service provider due to differing procedural practices. Generally, you would need to provide a notarised proof of identity and address for all proposed company officers, like directors and shareholders. If a corporate entity is a shareholder, business registration certificate, M&AA, shareholder roster and other related corporate documents would be required.

To incorporate a company in Singapore, you must focus on three key aspects. Determine an appropriate business structure, register your company with ACRA (Accounting & Corporate Regulatory Authority) for legal establishment and set up a corporate bank account, if needed.

After deciding your company’s name, you should define the kind of company you want to form.

The kinds include:

- Private company limited by shares

- Exempt private company

- Public company limited by guarantee

- Public company limited by shares

- Unlimited exempt private company

- Unlimited private company

- Unlimited public company

Next, define the closing date of your fiscal year and establish the yearly filing requirements. Crucially, appoint secretaries, directors, and other essential personnel (i.e., an auditor within the first 3 months of incorporation) while arranging the shareholders and share capital within your business. The company constitution and registered office address also need to be provided.

Private Limited Company: Private limited companies have under 50 shareholders and their shares are not publicly available. This structure offers maximum flexibility, with the company operating as a separate legal entity from its shareholders and directors. It has limited liability, meaning shareholders aren’t liable for debts exceeding the agreed share capital. A corporate bank account is necessary for this setup, and ownership transfer is straightforward.

Sole Proprietorship: In a Sole Proprietorship, the owner reaps all profits but also carries all risks. This setup doesn’t constitute a separate legal entity from the business owner, and all business debts are the owner’s personal responsibility due to unlimited liability. To register as a sole proprietor in Singapore, one must be a Singapore citizen, resident, or hold an entrepreneur passport.

Limited Liability Partnerships (LLP): An LLP allows firms to function as partnerships while benefiting from the advantages of a private limited company. An LLP is a separate legal entity, and partners are not liable for any loss or liability from the business.

ACRA represents the Accounting and Corporate Regulatory Authority of Singapore. It governs Singapore’s public accountants, business entities, and corporate service providers. Their role is to harmonize business compliance with disclosure obligations and statutory audit regulations of public accountants. They administer matters related to companies, business name registrations, and accountants, and represent the Singapore government in international affairs involving business entity registration, regulation, public accounting, and corporate service providers.

Upon successful company registration in Singapore, ACRA will dispatch an email confirmation to you. If necessary, an electronic version of the Certificate of Incorporation is available at a fee of S$50. Complimentary access to an electronic version of your company’s business profile will be granted, which will encompass the organizational structure and key particulars of your newly-formed entity. Once the registration is duly finalized, your company is eligible to initiate a bank account application with any Singaporean bank, contingent upon the bank management’s assessment and endorsement. Ensure you have on hand your passport, NRIC (National Registration Identity Card), and proof of residence for all directors, authorized signatories, and ultimate beneficiaries, alongside pertinent business documentation. Depending on the nature of your company’s operations, there may be a need to secure specific licenses. Should your company project an annual turnover surpassing S$1 million, it’s recommended to proceed with the registration for the Goods and Services Tax.

Singapore, with its appealing tax incentives, strategic geographical advantage, and a government that promotes a pro-business environment, emerges as a leading choice in Asia for foreign business magnates and budding entrepreneurs to either scale their operations or initiate a new venture.

Subsequent to establishing their business in Singapore, foreign entrepreneur have the avenue to apply for an Employment Pass (EP). This EP serves as an authorization for foreign leaders, managers, and professionals to pursue employment in Singapore. It’s crucial to underscore that the acceptance of the EP application lies at the discretion of the relevant governing bodies.

To circumvent potential complexities and uncertainties in the process, it’s wise for international entrepreneurs to onboard a corporate secretarial entity, such as Premia TNC, which can proficiently guide through the business setup phase and deliver an array of essential company formation solutions.

Singapore offers an array of tax incentives to foster business establishment within its borders. Entrepreneurs can benefit from the following tax privileges in the city-state:

- *Newly incorporated businesses can avail a 75% tax exemption on their initial S$100,000 of corporate profits during their first three fiscal years.

- *An additional tax relief of 50% is applicable on taxable earnings up to S$100,000.

- Company stakeholders in Singapore can relish a tax-free status on both capital appreciation and dividend earnings.

- Strengthening its global financial collaborations, Singapore has ratified Double Taxation Avoidance Agreements (DTA) with over 50 nations, encompassing Canada, China, France, Japan, and the UK.

*Eligibility criteria are in effect.

Foreign entrepreneurs are required to partner with a professional corporate service firm for registration, as self-registration isn’t permitted. To serve as the company’s local director, you need to secure either an Entrepreneur Pass or an Employment Pass.

You can easily confirm this by entering the company name into the search platform on ACRA’s website. If the company is registered, you’ll see details like the office address, company name, and Unique Entity Number (UEN).

Upon completion of the registration process, each Singaporean entity is assigned a Unique Entity Number (UEN) by the government. Local firms, LLPs, societies, and representative offices are all eligible to receive UENs, with ACRA overseeing issuance for limited partnerships, limited liability partnerships, foreign corporations, and public accounting firms.

Incorporated companies in Singapore must prepare and present the following financial statements at their Annual General Meeting (AGM):

- Directors’ Statement

- Director’s Report

- Comprehensive Income Statement

- Equity Change Statement

- Financial Position Statement

- Cash Flow Statement

- Notes to the Financial Statements

The annual return must be submitted to the Registrar within 7 days of following the end of the company’s fiscal year.

Within 6 months after incorporation, every Singaporean corporation is obligated to appoint a corporate secretary. This individual, who must be a Singapore resident, handles tasks like maintenance of registers, processing standard filings, and reporting changes to ACRA.

Absolutely, outsourcing business support from professional corporate service firms is a common practice among startups, allowing them to focus on their core business.

While a registered address is mandatory for company incorporation in Singapore, it need not be your operational office.

Under the Companies Act, all companies incorporated in Singapore must present financial statements in compliance with Singapore Financial Reporting Standards (SFRS). The SFRS are based on the International Financial Reporting Standards (IFRS), issued by the International Accounting Standards Board (IASB).

Establishing a company can be accomplished within a single business day, provided we receive all essential details and paperwork from you. However, the availability of local regulatory bodies is limited to standard business hours and closed on weekends.

A local address is a requirement for all registered companies in Singapore, both for compliance and official mail receipt. If you lack a physical address in Singapore, you can use our registered office service.

Anyone aged 18 or over can be a director, whether a Singaporean, a Singapore PR, or a foreigner. Multiple directors can be appointed. However, every company must have at least one resident director with Singapore citizenship or permanent residency. Non-residents need an Employment Pass or Entrepreneur Pass. Contact us to use our company incorporation services.

Premia TNC has the optimal solutions for all your business needs.

Get in touch today for a FREE consultation.

No hidden costs, no obligations.

Feel free to drop us an email too!

[email protected]

Premia TNC has the optimal solutions for all your business needs.

Get in touch today for a FREE consultation.

No hidden costs, no obligations.

Feel free to drop us an email too!

[email protected]