May 2, 2024

From Traditional to Digital: Looking into the Vietnam B2B E-Commerce Shift

In recent years, Vietnam's business landscape has undergone…

April 16, 2024

The Ins and Outs of a Limited Liability Company in Vietnam

Establishing a business in Vietnam can be a promising…

April 16, 2024

Legal Issues Related to Foreign loans without the Government’s Guarantee of Vietnam Company

Foreign loans without government guarantees have become an…

March 22, 2024

Unlocking Avenues: Discovering the Best Business Opportunities in Vietnam

Nestled in Southeast Asia, Vietnam is rapidly emerging as a…

March 13, 2024

Entering Electronic Contracts in Vietnam

Electronic contracts, also known as e-contracts, have…

March 6, 2024

E-commerce in Vietnam: Growing Cross Border Ecommerce Opportunities with China-Vietnam

Vietnam's economy is swiftly transforming with the surge of…

February 7, 2024

Legal Guide on Transferring a Manufacturing Factory in Vietnam

In the bustling landscape of Vietnam's economic growth,…

January 15, 2024

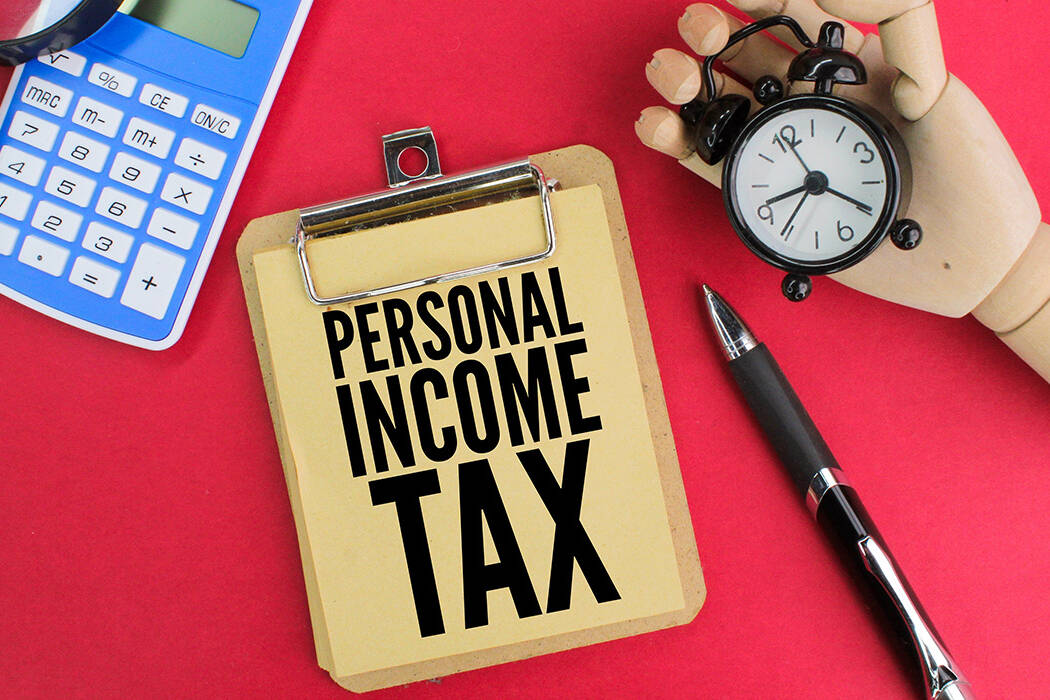

Staying Compliant: Unravel the Revised Personal Income Tax in Vietnam for 2024

We are at the forefront of regulatory updates as we embark…

January 15, 2024

Taxing Matters: A Closer Look at Corporate Tax in Vietnam

In the bustling landscape of Vietnam's economic growth,…

January 10, 2024

How to Establish Representative Office in Vietnam for Foreign Companies

Expanding into new territories presents both opportunities…