New Qualifying Criteria for Audit Exemption (Issue 1 of 4)

Starting from January 1, 2025, Malaysia has introduced new qualifying criteria for audit exemption, aimed at providing financial relief to micro and small businesses. The government’s objective is to reduce the costs of compliance and auditing for smaller companies, enabling them to focus on growing their operations. These changes align with the government’s policy to help businesses reduce operational costs and improve the ease of doing business in Malaysia. The new criteria also aim to encourage entrepreneurship and ensure that businesses, especially SMEs, remain competitive in a dynamic market.

This policy change follows the legislative framework outlined in the Companies Act 2016 and the Companies Commission of Malaysia Act 2001. Specifically, Section 267(2) of the Companies Act 2016 provides provisions for the Registrar to grant an audit exemption to qualifying private companies under certain conditions.

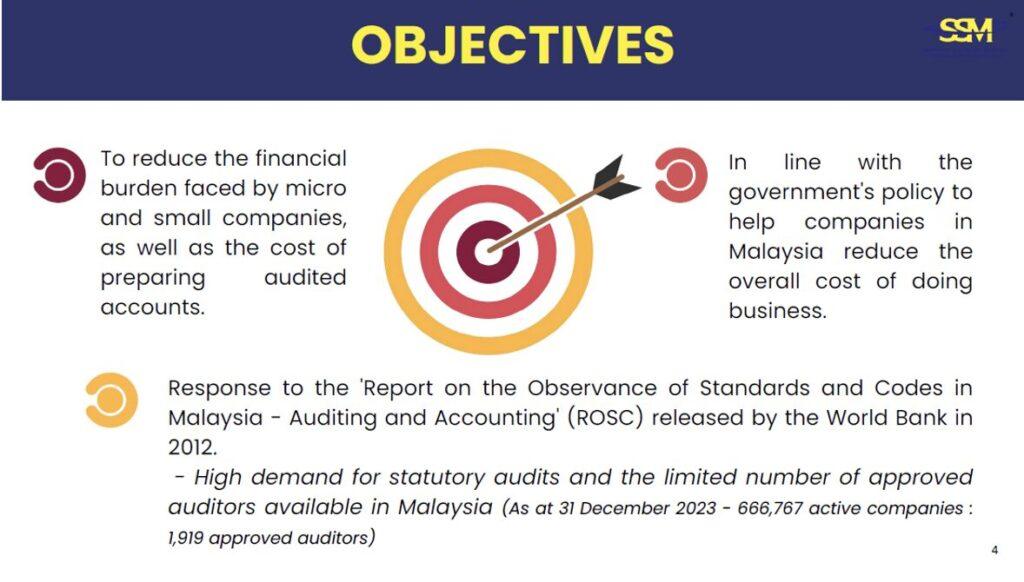

The following is the objectives of the audit exemption by the government:

Stay tune for the upcoming newsletter, we will share with you more on New Qualifying Criteria for Audit Exemption.