Two-Tiered Standard Rates for Salaries Tax from the Year of Assessment 2024-25

In the 2024-25 Budget, the Financial Secretary proposed a one-off reduction of 100% of the final tax for the year of assessment 2023/24 in respect of profits tax, salaries tax and tax under personal assessment, subject to a ceiling of $3,000 per case.

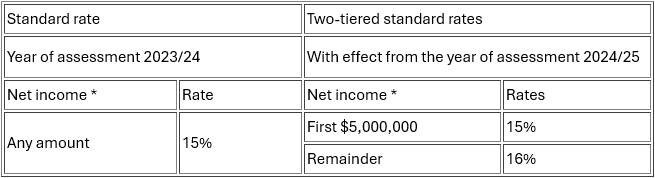

Furthermore, it is also proposed to implement a two-tiered standard rates regime for salaries tax and tax under personal assessment starting from the year of assessment 2024/25. The relevant legislation was passed by the Legislative Council on 22 May 2024 and gazetted on 31 May 2024.

In calculating the amount of tax under standard rate for a taxpayer whose net income exceeds $5 million, the first $5 million of the net income will continue to be subject to the standard rate of 15% and the portion of the net income exceeding $5 million will be subject to the standard rate of 16%.

Details are as follows:

* Net income = Total income – Deductions