2025-26 Budget – Other Key Tax-Related Measures

Except for a one-off reduction of profits tax, salaries tax and tax under personal assessment for year of assessment 2024/2025 by 100%, subject to a ceiling of HK$1,500 per case. Below are the summaries of tax-related proposals in the Budget.

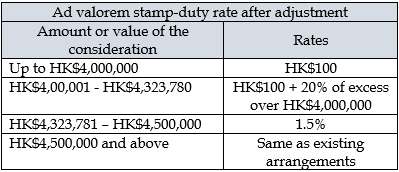

Stamp Duty

The maximum value of properties chargeable to a stamp duty of HK$100 has been increased to HK$4 million with effective from 26 February 2025.

Rates concession for domestic and non-domestic properties

Rates concession will be given to all ratepayers to offset the rates payable for the first quarter from of 2025-2026, subject to a ceiling of $500 for each rateable property.

Rating System

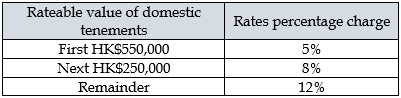

The progressive rating system for domestic tenements has taken effect following the gazettal of the Rating (Amendment) Ordinance 2024 on 1 November 2024. Starting from 1 January 2025

- For domestic tenements with rateable value of $550,000 or below (about 98% of private domestic tenements), the rates percentage charge remains at 5%.

- For domestic tenements with rateable value of $550,000 or below (about 98% of private domestic tenements), the rates percentage charge remains at 5%.