Termination Of Service

Where the employer is about to cease to employ an employee who is or is likely to be chargeable to tax in respect of income from the employment or an employee under his employment dies, the employer is required to furnish Form CP22A / CP22B not less than 30 days before the cessation of employment or not more than 30 days after being informed of the death.

However, the employer is not required to furnish such form where the income of an employee has been subject to a monthly tax deduction (MTD) or where the employee’s monthly remuneration is below the minimum amount of income that is subject to MTD, provided that the employee will continue working or not retiring from any employment in Malaysia.

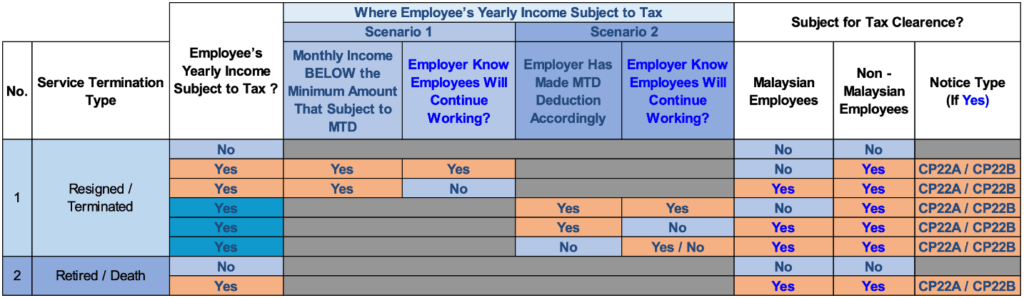

The table below is a general guide for employers to determine whether forms CP22 / CP22B notification is required to be submitted:

Form CP22A / CP22B can be submitted either online via the e-SPC application at MyTax Portal or at the IRBM office which handles the employee’s tax file.

The employer is required to withhold any monies payable to an employee who has ceased or is about to cease to be employed. The employer shall not pay any such money, except with the permission of the IRBM, to or for the benefit of the employee until 90 days after the receipt by the IRBM of the form.