Understanding Financial Statements: A Guide for Non-Accountants

Many business owners and managers tend to view financial statements as something that only their accountants need to worry about. In reality, these reports tell the true story of your company’s financial health. They reveal whether the business is growing sustainably, how efficiently resources are being used, and whether there is enough cash to meet upcoming obligations. Understanding your financial statements, even at a basic level, helps you make informed decisions and manage your company with greater confidence.

Balance Sheet

The first statement every business owner should understand is the Balance Sheet, also known as the Statement of Financial Position. It provides a snapshot of what your company owns, what it owes, and what remains as shareholders’ equity at a specific point in time. By reviewing your assets and liabilities, you can assess the stability of your business and its ability to handle future expansion or unexpected challenges. A strong balance sheet, with healthy liquidity and manageable debt, often signals a well-managed company to lenders and investors.

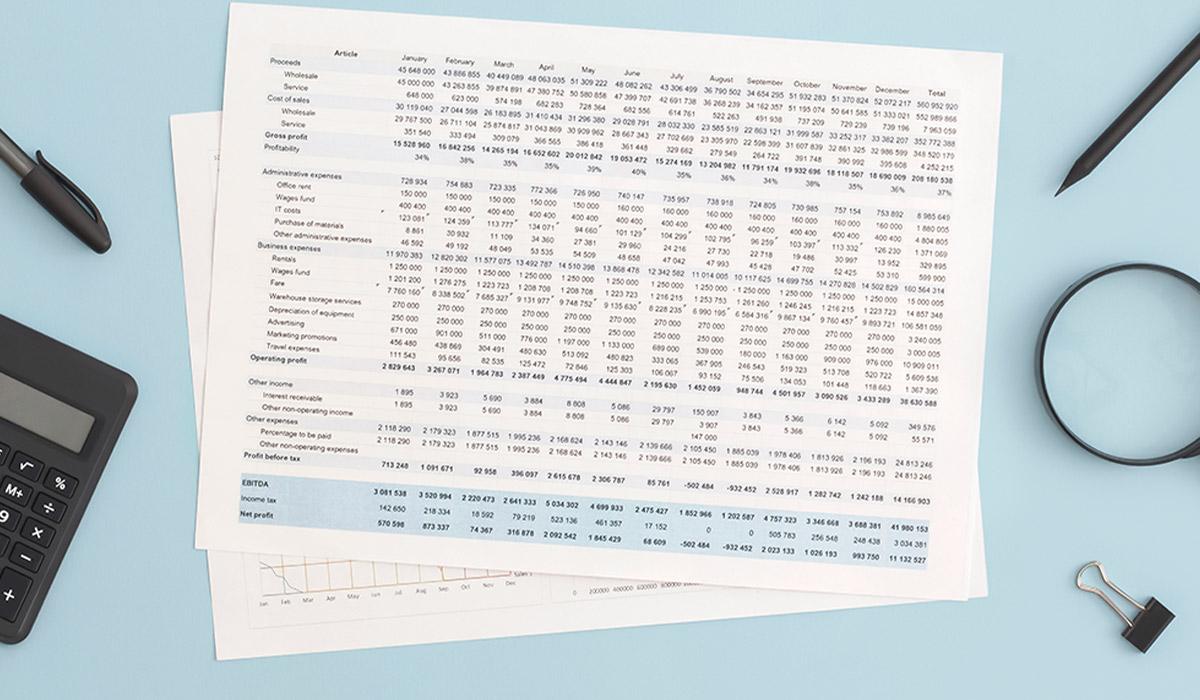

Income Statement

Next is the Income Statement, or Profit and Loss Statement, which summarises your revenue, expenses, and net profit over a defined period. This report shows how effectively your business generates income relative to the costs incurred. Regularly analysing your income statement allows you to identify profitable products or services, track cost trends, and make timely adjustments to pricing or expenses. It essentially serves as your performance report card, reflecting whether your business model is working as intended.

Cash Flow Statement

Equally important, though often overlooked, is the Cash Flow Statement. While your income statement may show a profit, that doesn’t always mean you have cash on hand. The cash flow statement records the actual inflows and outflows of money within your business — from operations, investments, and financing activities. Monitoring cash flow helps ensure that your company can meet payroll, pay suppliers, and reinvest in growth. Healthy cash flow is what truly keeps a business running day to day.

Financial statements are not just compliance tools; they are powerful management instruments that guide smarter business decisions. By reviewing them regularly, business owners can spot trends, identify potential risks early, and strengthen credibility with stakeholders such as banks, investors, and regulators. The key is to look beyond individual figures — compare results over time, observe important ratios, and interpret the balance sheet, income statement, and cash flow statement together for a complete picture. With even a basic understanding of these reports, non-accountants can gain clearer insights into their company’s performance and steer the business with greater confidence toward long-term success.