Income Tax Incentives for Foreign Professionals

According to Article 20 of the Act for the Recruitment and Employment of Foreign Professionals, foreign special professionals who engage in professional work and meet certain conditions—who do not have household registration in Taiwan(R.O.C.) and are residing in Taiwan(R.O.C.) for the first time due to work approval, or who have obtained an Employment Gold Card according to regulations and are employed to engage in professional work during its validity period—within five years starting from the taxable year when they first become residents of Taiwan and their salary income exceeds NTD 3 million, for each taxable year in which they reside in Taiwan(R.O.C.) for at least 183 days, half of the portion of their salary income exceeding NTD 3 million is exempted from inclusion in the total comprehensive income for taxation. Additionally, the provisions regarding the basic tax amount levied on overseas income in Article 12, Paragraph 1, Subparagraph 1 of the Income Basic Tax Act do not apply.

The term “first 5 years” in the tax incentives shall start from the year when the foreign special professional has resided in the R.O.C. for 183 days or more for the first time, and has an annual salary income over NTD3,000,000. The taxpayer cannot choose the starting year and applicable years as he/she wishes.

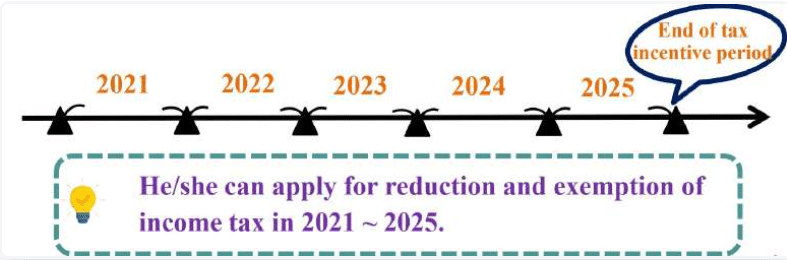

Example of a foreign professional’s tax incentive application as below:

A foreign professional “D”, obtaining the foreign special professional employment permit in 2021 and meeting the requirements, stays in the R.O.C. for 183 days or more and has an annual salary income over NT$3,000,000 derived from his special professional work during the years 2021 ~ 2025. In the year 2021 is the first applicable year and “D” can apply for the tax incentives from 2021 to 2025.