EPF’s New Account Structure: A Step Towards Financial Flexibility and Security [Issue 1 of 2]

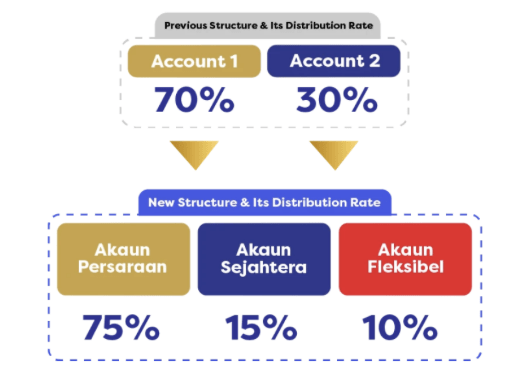

The Employees Provident Fund (EPF) has announced a restructuring of its members’ accounts under the age of 55 effective 11 May 2024 to better cater of financial needs and goals. Previously, the accounts were divided into Account 1 (70%) and Account 2 (30%). The new structure introduces three distinct accounts:

• Akaun Persaraan (75%): This is the new version of Account 1, focused on accumulating savings for long-term retirement. Its primary goal is to ensure you have a comfortable life after retirement.

• Akaun Sejahtera (15%): Originally part of Account 2, this account is intended to meet pre-retirement needs. It covers medium-term requirements that contribute to your retirement wellbeing. You can withdraw savings from this account for housing, education, health, insurance/takaful protection, Hajj, and upon reaching age 50, subject to EPF terms and conditions.

• Akaun Fleksibel (10%): Designed for short-term financial needs, this account allows for withdrawals at any time, under specific terms and conditions. It is meant for emergency purposes and immediate necessities.

This new structure aims to provide more flexibility and support for different stages of your financial journey. Your accounts will be automatically adjusted to reflect these changes, ensuring a smoother transition.

Stay tune for the upcoming newsletter, we will share with you more on balance transfer to EPF Account 3.