Taiwan boasts one of the world’s lowest individual tax rates at just 5%, making it an attractive destination for expatriates and businesses alike. This guide aims to demystify the Taiwan tax system, providing a comprehensive overview of the various tax brackets and rates applicable to individuals. Additionally, it will offer practical insights on how to navigate the tax payment process in Taiwan, ensuring you are well-informed and compliant with local regulations. Whether you are an expatriate or a business owner, understanding these tax nuances is crucial for effective financial planning and management.

Looking Into the Basics of the Taiwan Tax Rate

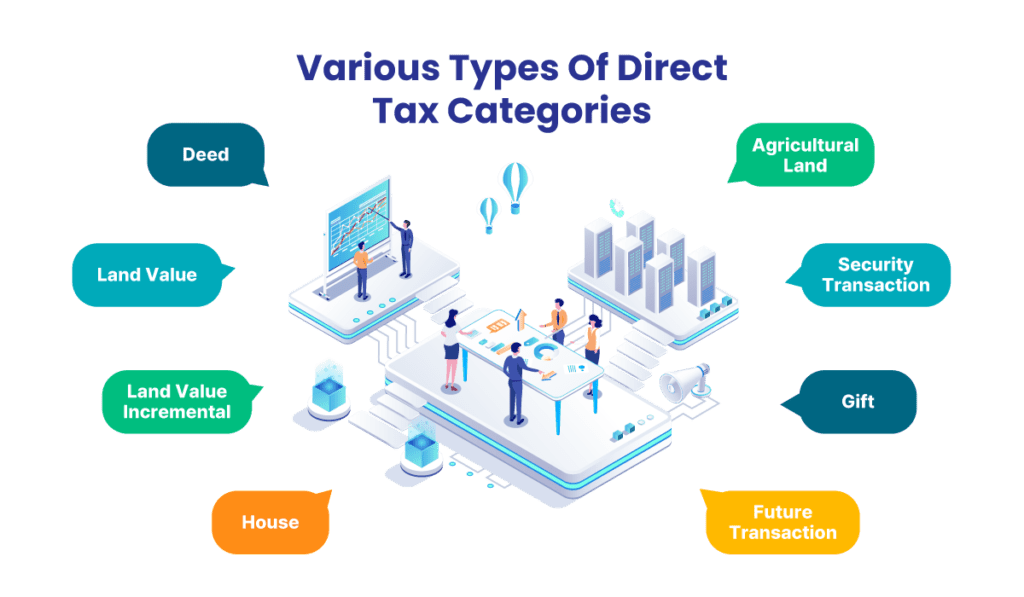

Taiwan’s tax system is divided into national and local levels, with the Ministry of Finance responsible for collecting national taxes from individuals and businesses, while local governments collect taxes related to buildings, land, and acquisitions through regional tax offices. The government imposes various direct taxes, including deed, land value, land value incremental, house, agricultural land, security transaction, gift, and future transaction taxes. Additionally, Taiwan has a range of indirect taxes at both national and local levels.

The Taiwan Tax Rate for Individuals and Businesses

Throughout this section, we will define the various tax rates that Taiwan has for companies, as well as for resident and non-resident aliens. Additionally, each section will cover basic information that everyone should understand about these rates, who must pay them, and any relevant exceptions.

Taiwan Tax Rate for Expats

To be considered a tax resident in Taiwan, an individual must reside in the country for at least 183 days within a tax year. For foreigners who meet this criterion, the individual income tax rate ranges from 5% to 40%, depending on their income bracket. Conversely, non-resident aliens who stay in Taiwan for less than 183 days in a given year are subject to a flat tax rate of 18%. This means that if an individual earns over NTD 2,420,000 annually but does not meet the 183-day residency requirement, they will be taxed at 18% instead of the higher rates applicable to tax residents.

There is an exception for non-resident aliens who visit Taiwan for business purposes and stay for less than 90 days in a tax year. If their salary is paid in their home country, it is exempt from income tax filing in Taiwan. This provision helps to avoid double taxation and simplifies tax obligations for short-term business visitors.

Corporate Tax Rate in Taiwan

Taiwan’s corporate tax rate stands at 20%, which is notably lower than that of many advanced countries. For-profit entities are required to report all business income, whether sourced domestically or internationally, with the corporate income tax return deadline set for May 31st each year. Businesses earning income from overseas can utilize a foreign tax credit to deduct taxes paid in the country where the income was generated, though this credit cannot exceed the amount of tax that would be applied under Taiwan’s income tax regulations.

Additionally, Taiwan has established tax treaties with over 30 countries to help mitigate the risk of double taxation. It is advisable for businesses to consult with tax experts to navigate these treaties effectively and ensure compliance while optimizing their tax obligations.

Withholding Tax in Taiwan

In Taiwan, employers are responsible for withholding tax from employees’ paychecks, deducting a certain amount for tax purposes. For residents, withholding rates range from 0% to 10% based on income source, with a standard 5% for general salaries. Non-residents face higher rates, ranging from 18% to 21%, with a standard 18% for general salaries.

Value Added Tax in Taiwan

Value-added tax (VAT), also known as business tax, is imposed on the sale of goods and services at various stages of the supply chain in Taiwan. The current VAT rate for general products and services is 5%. For imported goods, VAT is calculated at the standard rate of 5% on the gross value, which includes additional applicable taxes and fees such as those on tobacco, alcohol, commodities, and customs duties.

Securities Transaction Tax in Taiwan

Individuals are required to pay taxes on all securities transactions, with the exception of specific tax-exempt securities and government bonds. The tax rate for shares and options is 0.03%, while futures transactions are taxed at rates ranging from 0.000001% to 0.6%, depending on the selling price of the security.

Luxury Tax in Taiwan

Dealers selling private jets, helicopters, or passenger vehicles valued at NTD$3,000,000 or more are subject to a 10% luxury tax per sale. Additionally, high-end furniture sellers must pay a 10% tax on sales of preserved wildlife products worth NTD$500,000 or more.

Land Value Increment Tax in Taiwan

When land is sold, it is subject to a land value increment tax (LVIT), which is calculated based on the increase in its government-assessed value. The LVIT includes a special tax rate of 10%, with progressive rates ranging from 10% to 40%.

Property Tax in Taiwan

Real estate is assessed annually, and a tax rate is determined based on the official assessed value. The tax rates are as follows: land value ranges from 1% to 5.5%, commercial properties from 3% to 5%, and non-commercial properties from 1.2% to 3.6%.

Stamp Tax in Taiwan

In Taiwan, individuals handling contractual agreements and deeds of sale for real estate or movable properties must pay a stamp tax. The rate for real estate transactions and contractual agreements is 0.01% of the contract price, while the rate for deeds of movable properties is NTD$12 per piece. Additionally, receipts of payments are taxed at 0.04% of the amount received.

Taiwan Tax Rate Comparison with Other Asian Economies

Corporate Tax Rate in Taiwan and the Region

The standard corporate income tax rate in Taiwan is 20%, which places it in a competitive position within Asia. Compared to other major economies, Taiwan offers a stable rate that appeals to businesses seeking a strategic location in the region. For example, Singapore applies a flat corporate tax rate of 17%, widely regarded as one of the lowest in Asia. Hong Kong implements a two-tier system, taxing the first HKD 2 million of profits at 8.25% and any remaining profits at 16.5%. South Korea’s corporate tax rates range from 10% to 25%, depending on income levels, while Japan imposes an effective corporate tax rate of around 30%, which combines national and local taxes.

Personal Income Tax Rate Comparison

Taiwan adopts a progressive personal income tax system, with rates ranging from 5% to 40%. This structure aligns with many developed economies across the region. In comparison, Hong Kong has a maximum salary tax capped at 17%, making it particularly attractive for high-income earners. Singapore’s personal income tax rates progress from 0% to 24%, which is also favorable for both residents and expatriates. Meanwhile, South Korea and Japan apply higher personal income tax rates, with top marginal brackets exceeding 40%, which places Taiwan in a moderate position for individuals earning higher incomes.

Positioning of the Taiwan Tax Rate in Asia

While Taiwan may not always offer the lowest tax rates in Asia, its balanced tax regime, combined with a favorable business environment and global market access, ensures it remains an appealing option for companies and individuals. The combination of moderate tax rates and sector-specific incentives continues to strengthen Taiwan’s competitive standing in the region.

Tax Incentives and Exemptions Impacting the Taiwan Tax Rate

Encouraging Innovation through R&D Incentives

To support innovation and technological advancement, Taiwan provides tax deductions and credits for businesses engaged in qualifying research and development activities. Companies involved in R&D can reduce their taxable income, which effectively lowers their overall Taiwan tax rate and encourages continued investment in innovation.

Benefits in Special Economic Zones

Taiwan has established several special economic areas, including science parks, export processing zones, and free trade zones. Preferential tax treatment may be available to businesses that operate within these designated zones. Incentives often include reduced income tax rates, import duty exemptions, and simplified customs procedures, making these zones highly attractive for both domestic and foreign enterprises.

International Tax Relief through Double Tax Agreements

Taiwan’s extensive network of double taxation agreements (DTAs) provides relief for businesses and individuals engaged in cross-border transactions. Under these agreements, reduced withholding tax rates apply to dividends, interest, and royalty payments to non-residents. This arrangement helps prevent double taxation and lowers the effective Taiwan tax rate for foreign investors and multinational companies operating in Taiwan.

Maintaining a Competitive Tax Environment

These incentives and exemptions reflect Taiwan’s broader strategy to remain competitive within the global market. By offering targeted tax benefits, Taiwan encourages foreign investment, supports key industries, and strengthens its reputation as a regional hub for innovation and economic growth.

Managing Tax Filing and Payment in Taiwan

Filing taxes in Taiwan is straightforward, with options to visit a tax office for assistance or use the e-filing system. Payment methods include convenience stores (7-11, Hi-Life, OK Mart, Family Mart), wire transfer, debit or credit cards, paper checks, and cash.

Set Up for Tax Season in Taiwan with Premia TNC’s Assistance

Taiwan offers a straightforward, expat-friendly tax environment with generally lower tax rates than many other countries. Designed to accommodate both individuals and businesses, the system ensures ease in filing and payment processes. Whether you are an individual or a business establishing operations, understanding Taiwan’s tax regulations is key to achieving full compliance and unlocking potential tax benefits.

Premia TNC provides expert tax services tailored to meet the needs of businesses and expats in Taiwan. From filing tax returns and securing tax incentives to personalized tax planning, our professionals ensure seamless compliance with local tax laws. With our trusted guidance, you can focus on growing your business, knowing that your tax obligations are in expert hands. Partner with Premia TNC for unparalleled expertise and reliable support in navigating Taiwan’s tax landscape.

FAQs

How does one become a tax residency in Taiwan, and how is the duration of stay in Taiwan calculated?

Tax residency in Taiwan is established if you stay for 183 days or more in a calendar year or if you have Taiwanese nationality, maintain a registered household, and stay for at least one day that year. The arrival day doesn’t count, but the departure day does. Tracking your stay through passport stamps is recommended.

When is the deadline for Taiwan income tax payments?

The deadline for income tax payments in Taiwan is June 3rd, and penalties apply for late payments.

What factors determine a company's obligation of Taiwan income tax?

Companies headquartered in Taiwan are taxed on both domestic and international income, while foreign companies are only taxed on income generated within Taiwan.

What constitutes the business tax system in Taiwan?

Taiwan operates two tax systems: VAT, which applies to general industries at each stage of production or sale, and non-VAT, which applies to specific sectors like banking and clubs.

What is the extent of VAT and applicable tax rate?

VAT covers sales and services within Taiwan (including imported goods and services used domestically) and applies at a standard rate of 5%.

Related Posts

- Taiwan Tax Filling: Everything You Should Know About Taiwan’s Tax Filling

- Taiwan Withholding Tax Guide For Non-Resident Payees

- The Ultimate Guide to Business Tax in Taiwan

- What Foreigners Need To Know About Tax Filing Deadline In Taiwan

- A Detailed Guide for Taiwan Tax Residency